As we are all experiencing firsthand, the spread of COVID-19 has changed the global landscape, affecting our financial, professional, and social environments. The sudden disruptions caused by this public health crisis are presenting economic challenges with growing repercussions. While some factors affecting financial well-being are beyond individual control, financial knowledge can help people better manage their finances through times of hardship and times of prosperity. On this page, GFLEC offers suggestions and resources to manage our personal finances and buffer ourselves against the financial emergency caused by COVID-19.

Ten Suggestions to Manage Money in the Time of Crisis

Learn What the National and Local Government is Providing in This Time of Crisis

Financial Resources From Government Agencies »

Unemployment Insurance Relief During COVID-19 Outbreak »

Deciding How to Best Apply Your Stimulus Check »

How to Use Your Economic Impact Payment Prepaid Debit Card Without Paying a Fee »

Repaying Mortgage Forbearance: What you Need to Know »

Know Your Data: CFPB's Updated List of Reporting Companies »

Here's What's In The American Rescue Plan »

What you Need to Know About the Third Round of Stimulus Payments »

More Details About the Third Round of Economic Impact Payments »

You Have a Reverse Mortgage: Know Your Rights and Responsibilities »

Proteja sus finanzas durante la pandemia del Coronavirus »

Tarjetas de Débito Prepagadas de Pago por Impacto Económico »

Aplazamientos de Hipotecas en la Ley CARES »

Herramientas que Puede Usar Cuando no Pueda Pagar sus Facturas »

Guía para entender el estímulo económico por el COVID-19 »

Más Detalles Sobre la Tercera Ronda de Pagos de Impacto Económico »

Herramientas que Puede Usar Cuando no Pueda Pagar sus Facturas »

Learn About Possible Hardship Adjustments in Financial and Other Contracts

| (Different Payment Options and Due Dates for Credit Cards, Taxes, Bills and so On) |

Protect Yourself Financially From the Impact of the Coronavirus »

Mortgage Help for Homeowners Impacted by the Coronavirus »

Information for Student Loan Borrowers »

Help for Homeowners and Renters Concerned About Making Payments »

Mortgage Relief Deadlines Extended »

5 Steps to Ask for Mortgage Forbearance Due to the Coronavirus »

Tools to Help When you Can't Pay Bills »

Guide to Help Military Families With Unique Financial Challenges »

Revisit and Create a Budget to Manage the New Conditions Imposed by the Crisis

Coronavirus Budgeting Tips From a Financial Planner »

Should You Take Social Security Early to Weather Coronavirus? »

Three Budget Friendly Ways to Improve Your Financial Hygiene »

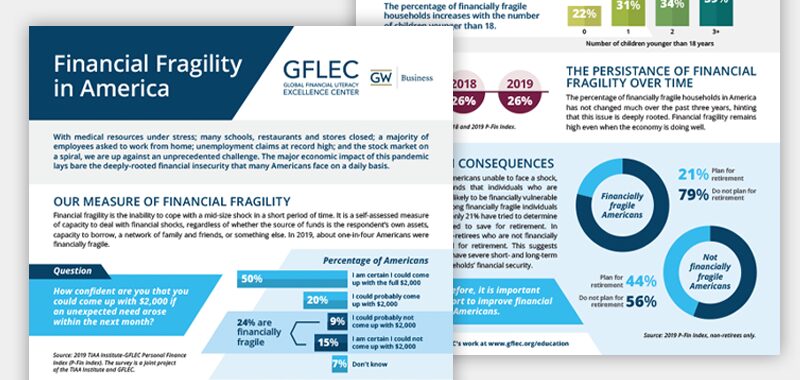

Are You Financially Fragile, or Could You Soon Be? Take This Quiz to Find Out »

How to Teach Your Kids About Money: 5 Tactics from the Experts »

Take Advantage of Online Technology to Manage Your Money as Well as to Compare Terms and Search for the Best Offer Available

Manage Debt

America Saves: Debt Repayment »

Videos to Spark Action: Debt »

#ThinkLikeASaver: Buying Your First Home (America Saves video)

You Have a Reverse Mortgage: Know Your Rights and Responsibilities »

Protect Yourself Financially From the Impact of the Coronavirus »

Which Debts and Bills Should You Pay Off First During COVID-19? »

Coronavirus and Dealing With Debt: Tips to Help Ease the Impact »

Credit Card Debt During Coronavirus: Relief Options and Tips »

Considerations Before Applying for a Personal Loan During the Pandemic »

Protect Your Credit Score

How to Manage Your Personal Finances During Times of Emergency

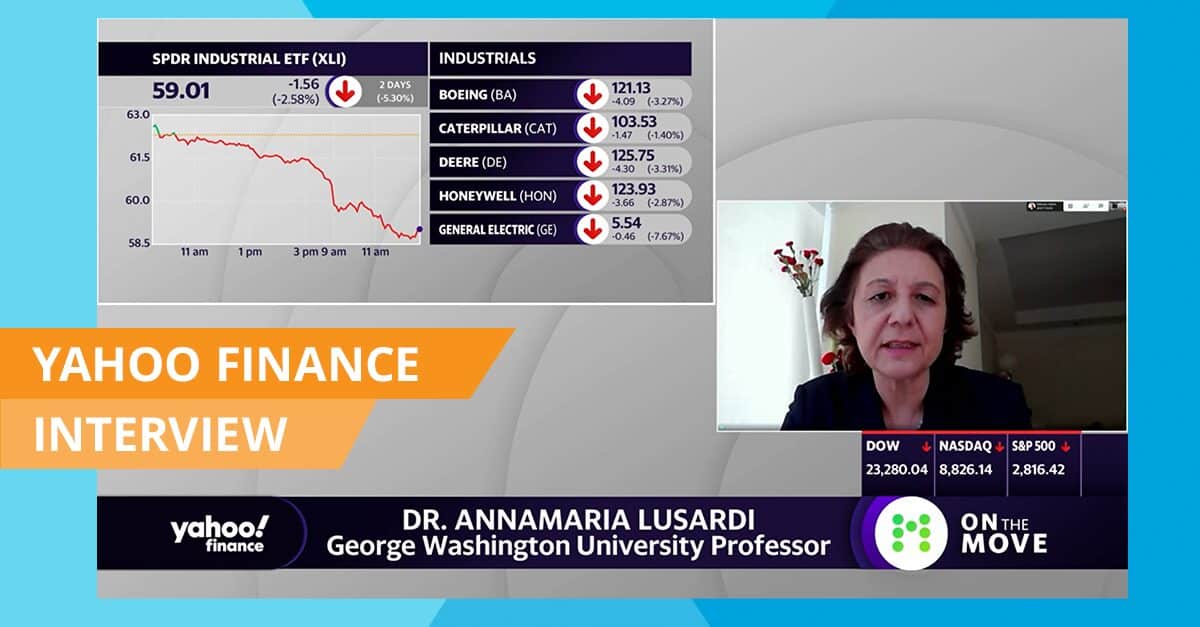

Director Lusardi's Interview | May 13, 2020

Financial Security During Challenging Times - Jean Chatzky’s Facebook Live

Director Lusardi's Interview | April 29, 2020

Managing Personal Finances During COVID-19 - Fieldstone Leadership Network SD Webinar

Kristen Burnell's Presentation | April 23, 2020

Teach Children About Personal Finance: Find Fun and Free Activities for Your Kids

Fast Lane Parent's Guide | April 2020

"How to Teach Financial Literacy to Kids in Uncertain Economic Times"

Director Lusardi's Houghton Mifflin Harcourt Interview | April 13, 2020

"3 Ways to Make Financial Literacy Month Count During the Coronavirus"

Director Lusardi's CNBC op-ed | April 1, 2020

"The Money Will Run Short for Many Americans. Start Planning Now for When it Happens"

Director Lusardi's CNBC op-ed | March 18, 2020

Building Financial Resilience in Turbulent Times – Online EBF Seminar

Director Lusardi's Presentation | March 24, 2020

"U.S. Workers, Businesses Lack Funds to Tide Them Over Until Help Comes"

Director Lusardi was quoted in this Wall Street Journal article. | March 24, 2020