Year-End Message from Annamaria Lusardi

As we celebrate what GFLEC and our partners accomplished this year to elevate financial literacy around the world, we are especially proud of 10 milestones we reached. In 2022, we: 1. Doubled our efforts to inform policy makers and to promote policy changes that can improve financial well-being around the world. GFLEC presented at several high-profile […]

The Meta-Analysis of Financial Education Programs

Financial education works and is cost-effective. That’s the key takeaway of “Financial education affects financial knowledge and downstream behaviors,” the worldwide meta-analysis co-authored by Tim Kaiser, Annamaria Lusardi, Lukas Menkhoff, and Carly Urban. The scholars considered more than a thousand published studies before concentrating on the most rigorous programs. The findings are based on 76 […]

10th Anniversary

GFLEC’s Decennial Journey and Impact 2011-2021 Ten years ago, the Global Financial Literacy Excellence Center (GFLEC) launched with a clear vision: a future in which everyone is equipped to manage their personal finances and, as a result, achieve their dreams. In its tireless work toward that goal, GFLEC has boldly positioned itself as the world’s […]

G53 Network

At GFLEC, we are proud to present a new initiative to elevate the financial literacy and personal finance field: a global network of researchers. We are making this bold move, which reflects the aspiration of many experts around the world, as we celebrate our first 10 years. This novel network will foster rigorous, high-quality academic […]

The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index)

The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) measures knowledge and understanding that enable sound financial decision making and effective management of personal finances among U.S. adults. The P-Fin Index is an annual survey developed by the TIAA Institute and the Global Financial Literacy Excellence Center, in consultation with Greenwald & Associates. It is unique […]

Workplace Financial Wellness

Holistic financial wellness programs have the power to establish a more satisfied, engaged, and productive workforce. Beyond an attractive benefit for individual employees, promoting financial capability boosts workplace engagement and productivity. Many companies are implementing new programs to help employees with their finances. Establishing effective workplace programs will be crucial for employers who want to help their workers and help themselves […]

Millennial Mobile Payment Users

The study examines data from two surveys—the 2015 National Financial Capability Study and the 2016 GFLEC Mobile Payment Survey—to provide insights on the financial capability of American Millennials who use mobile payments.

Entrepreneurship among Baby Boomers

Annamaria Lusardi, GFLEC Dimitris Christelis, University of Naples Federico II, CSEF, CEPAR and NETSPAR Carlo de Bassa Scheresberg, GFLECThis research has been supported by a generous grant from the Ewing Marion Kauffman Foundation. The evolution of entrepreneurship among Baby Boomers (i.e., those born between 1946 and 1964) is an important topic in economic research and […]

Money, financial literacy and risk in the digital age

In November 2016, Allianz, in collaboration with Director Annamaria Lusardi, surveyed a total of 10,000 (approximately 1,000 people in each country) in the western European countries of Austria, Belgium, France, Germany, Italy, the Netherlands, Portugal, Spain, Switzerland, and the United Kingdom to better understand their financial and risk literacy and financial decision making. The relationship between financial literacy and relevant financial outcomes (borrowing and investing behavior and planning […]

National Financial Capability Study

The National Financial Capability Study (NFCS) is a large-scale, multi-year project that measures Americans’ financial capability. The FINRA Investor Education Foundation commissioned this national study in consultation with the U.S. Department of the Treasury and other federal agencies. The NFCS was first conducted in 2009 and then repeated every three years. It aims to benchmark […]

Financial Literacy for Professional Athletes

Financial problems are common among professional athletes, as many professional athletes lack the skills necessary to effectively manage their personal finances. Our research shows that athletes start declaring bankruptcy as early as two years after the end of their athletic careers and 16% of NFL players will go bankrupt within the twelve years following retirement. Conducting research relating to the NFL and NBA, GFLEC highlighted financial issues among professional athletes and is working to create effective solutions for this group […]

S&P Global FinLit Survey

The Standard & Poor’s Ratings Services Global Financial Literacy Survey is the world’s largest, most comprehensive global measurement of financial literacy. It probes knowledge of four basic financial concepts: risk diversification, inflation, numeracy, and interest compounding. The survey is based on interviews with more than 150,000 adults in over 140 countries […]

Financial Literacy Programme

Through the support of the European Investment Bank Institute, Director Annamaria Lusardi of GFLEC and Dr. Rob Alessie of the University of Groningen are spearheading the Financial Literacy Programme, an international call to action for financial literacy. The Financial Literacy Programme unites financial literacy thought-leaders in Germany, Italy, the Netherlands, Portugal, Spain, Sweden, Switzerland, and Turkey […]

What’s the Big Idea in Financial Literacy?

Video Series Launched in April 2015, GFLEC’s video series, “What’s the big idea in financial literacy?,” provides brief videos on key topics within financial literacy. The speakers include members of the GFLEC team as well as its collaborators.

FinLit Talks

This video series offers concise summaries of in-depth academic and practitioner presentations, in plain English, for dissemination to a worldwide audience. For convenient viewing, most videos are between three and six minutes long. FinLit Talks with Annamaria Lusardi of GFLEC and Magda Bianco of the Bank of Italy on Challenges for Financial Inclusion: The Role for […]

International Federation Of Finance Museums

The mission of the International Federation of Finance Museums (IFFM) is to provide a framework for greater collaboration among museums, facilitating the sharing of exhibits, the exchange of scholarship and scholarly resources, and the interchange of information and knowledge. The IFFM also aims to develop and implement innovative ideas and programs to advance financial literacy […]

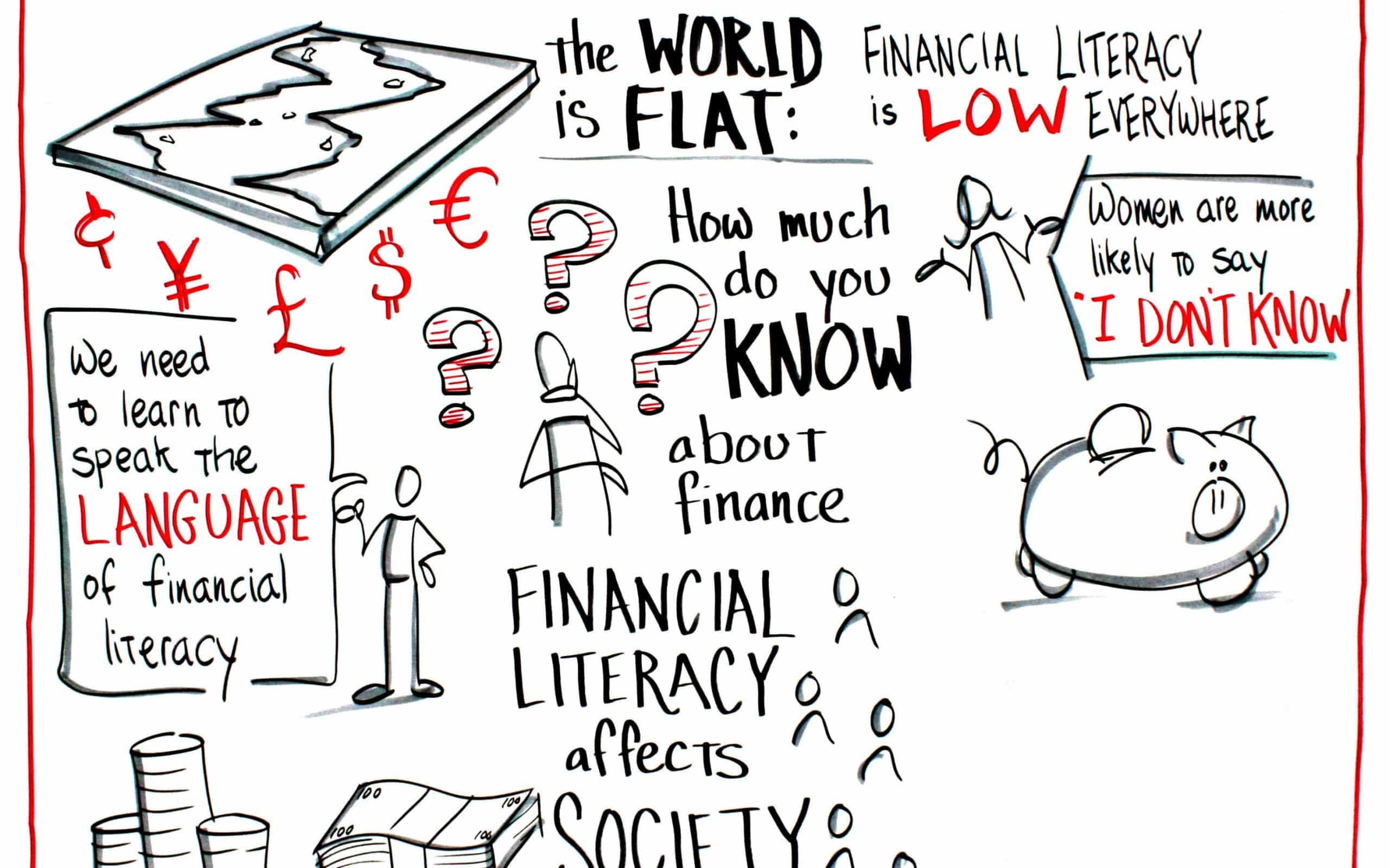

FLAT World

In 2004, the “Big Three” questions, created by GFLEC Director Annamaria Lusardi and Prof. Olivia Mitchell of the Wharton School, were first fielded in the U.S. Health and Retirement Study. Since then, the exact questions and various variations have been used to measure financial literacy around the world. This page features the findings in 15 […]

TEDx Foggy Bottom 2014

Financial Literacy, Illuminated GFLEC Director Annamaria Lusardi joined an eclectic group of thought leaders and innovators—including a poet, neurologist, chalk artist, and professional counselor—onstage at a special TEDx event hosted by the George Washington University on February 7, 2014. Director Lusardi spoke to an audience of more than one thousand people about her research on […]