What is the NFCS

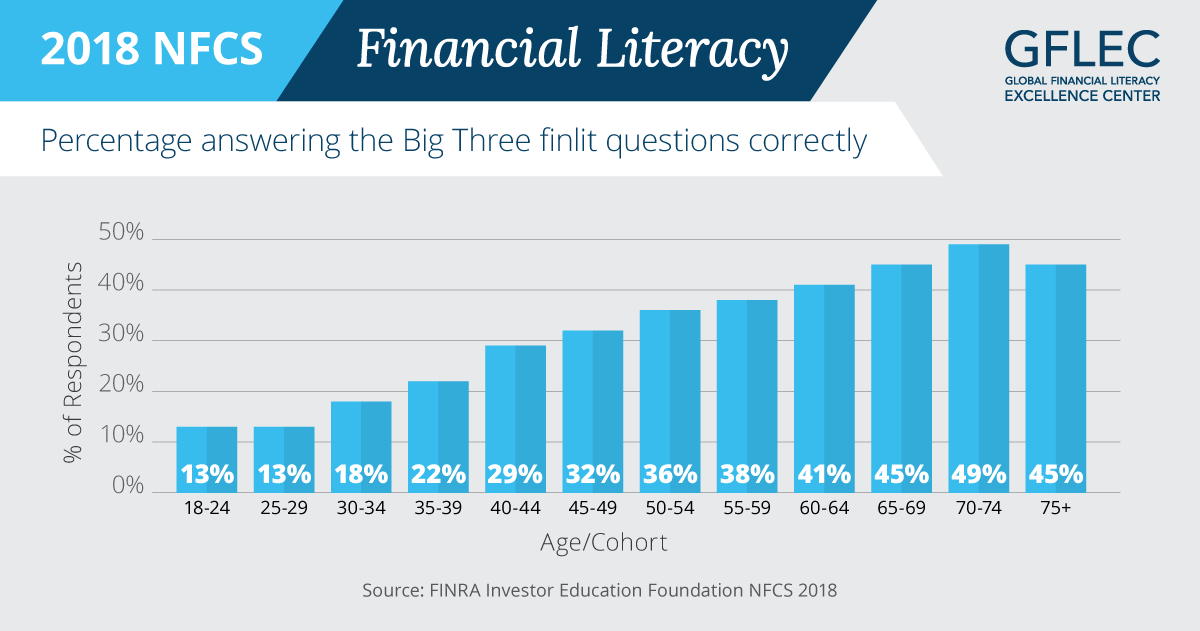

The National Financial Capability Study (NFCS) is a large-scale, multi-year project that measures Americans’ financial capability. The FINRA Investor Education Foundation commissioned this national study in consultation with the U.S. Department of the Treasury and other federal agencies. The NFCS was first conducted in 2009 and then repeated every three years. It aims to benchmark key indicators of financial capability and evaluate how these indicators vary with underlying demographic, behavioral, attitudinal and financial literacy characteristics. In each wave, the study deepened the exploration of topics that are highly relevant today.

The NFCS provides information on Americans’ financial capability drawing from a sample of over 25,000 respondents. The large sample size allows researchers not only to study financial capability among the entire population, but also to slice the data in different ways to provide detailed studies on population subgroups.

The study assesses financial capability by looking at four key components:

![]()

Click Here for the 2018 Full Report of National Findings ➤

GFLEC has been involved with the NFCS study since its inception. Director Lusardi has been academic adviser to the FINRA Investor Education Foundation since the first wave of the study, assisting with the design of the survey instruments and co-authoring the reports. GFLEC and the FINRA Investor Education Foundation also co-hosted the release of the 2012 data and the release of the 2015 data at the George Washington University.

Partner with Us

Our expertise and experience with the NFCS data can give you unprecedented insights on the financial capability of population segments of interest to your organization. Our analyses will inform your programs and will help you develop targeted and effective solutions.

Working with GFLEC will position you to become a thought leader in financial capability. We collaborate with several major institutions in the United States and around the world to analyze the NFCS data. Our team can prepare reports, white papers, policy briefs, infographics, presentations, and other materials customized for your needs.

Work with GFLEC to

- Inform your programs

- Advise your policy and corporate decisions

- Compare data to national benchmarks

- Utilize evidence-based methods

- Become a thought leader in the area

- Create media attention

Supporters of our NFCS Research Include

- Filene Research Institute

- FINRA Investor Education Foundation

- National Endowment for Financial Education

- PwC

- TIAA Institute

Some of Our Work

GFLEC’s work on the NFCS started with the first wave of data released in 2009. Some of our research efforts have yielded important findings. You can find samples of our work in the links below.

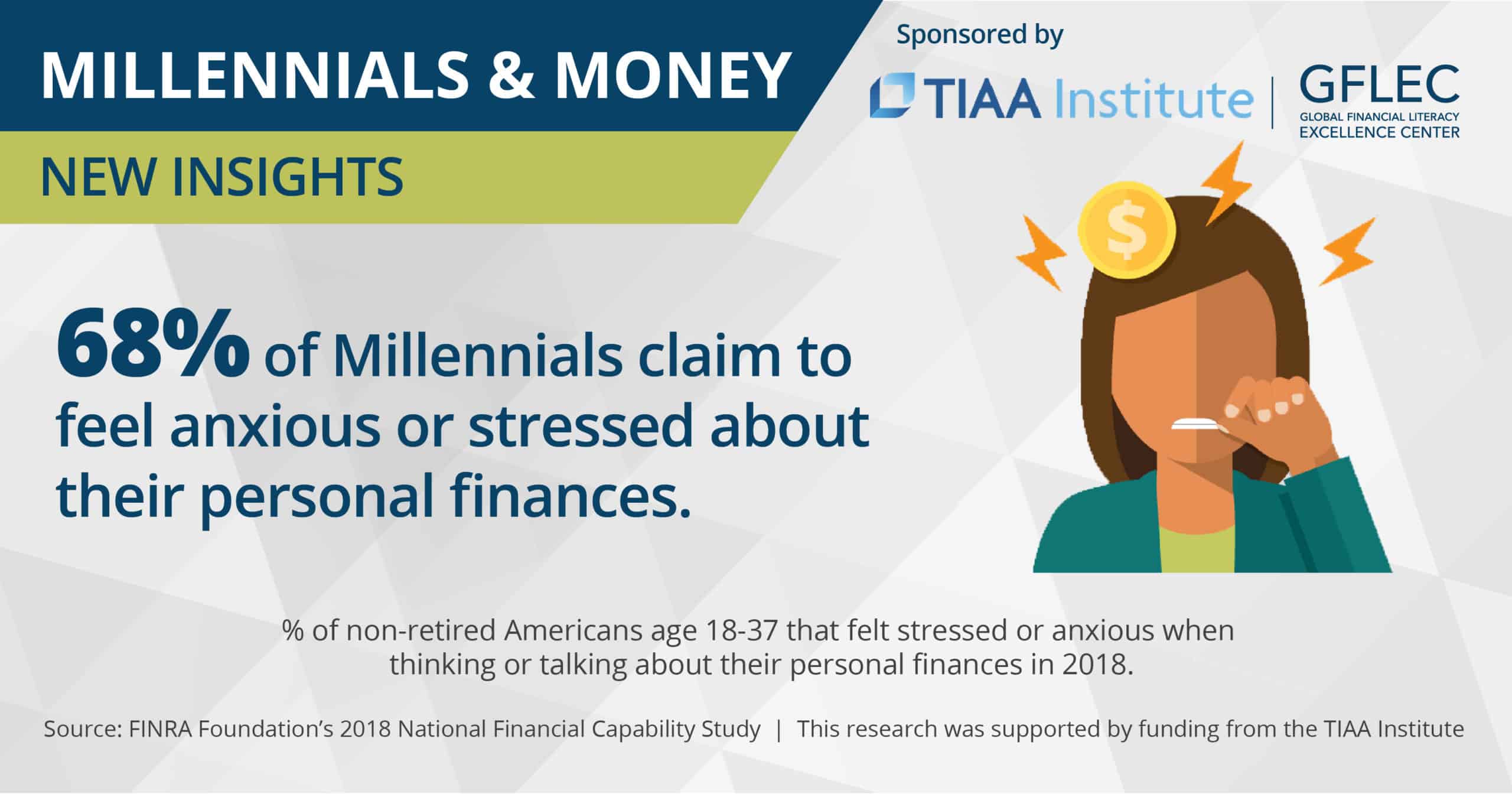

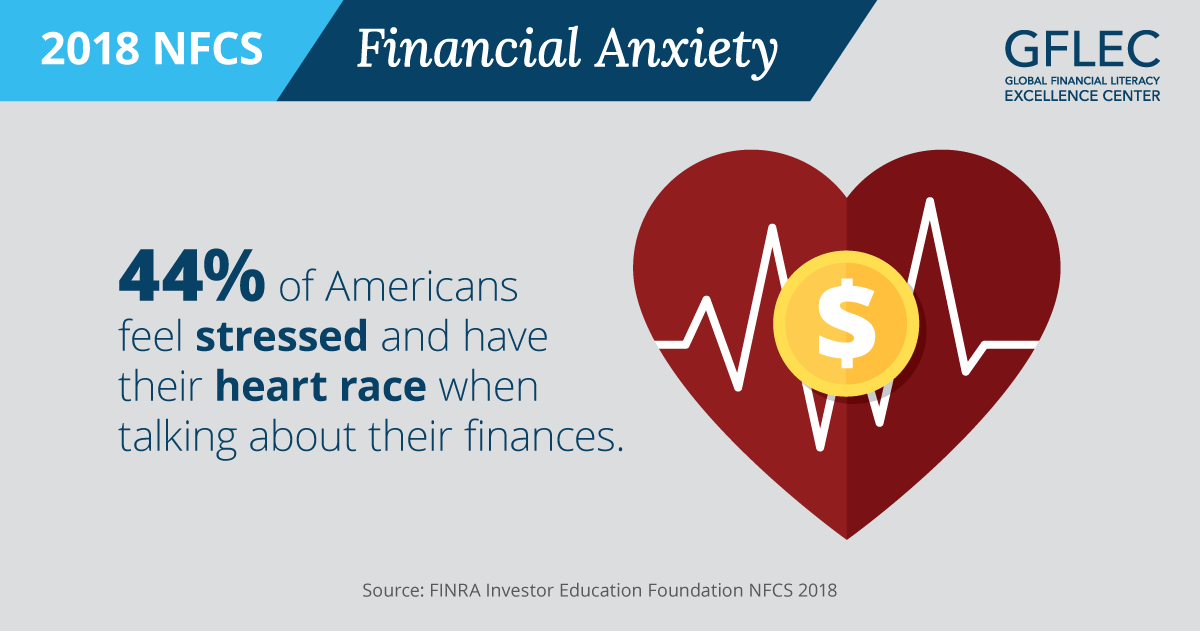

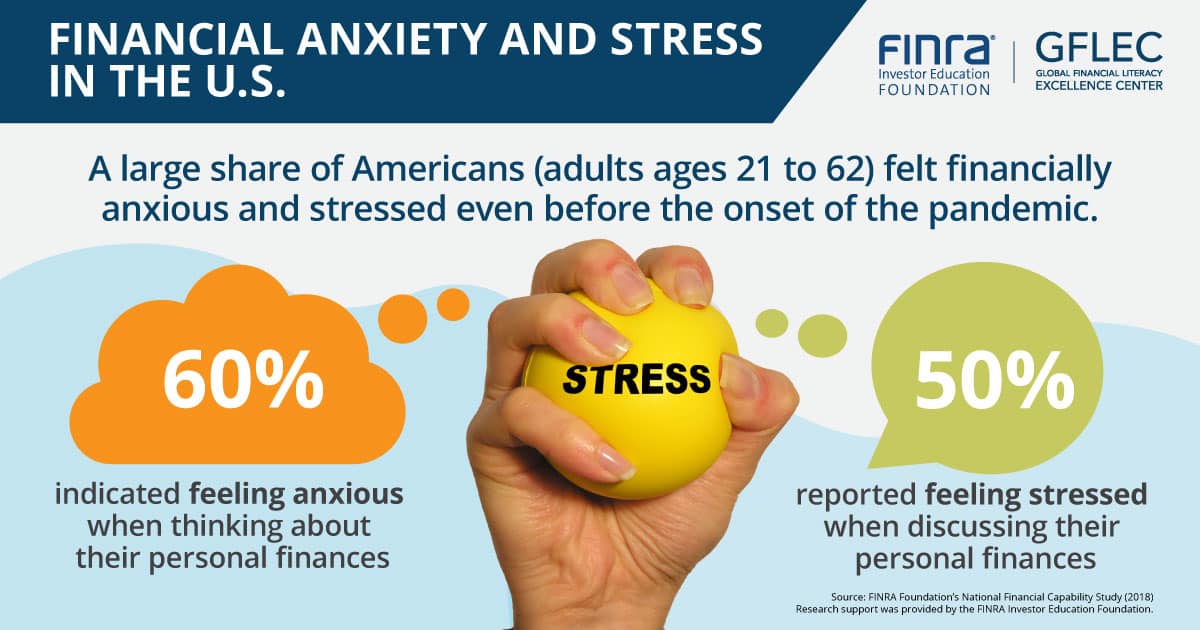

Financial Anxiety and Stress |

Financial Anxiety and Stress Among U.S. Adults (Issue Brief) | September 2021

Financial Anxiety and Stress Among U.S. Households (Report) | April 2021

Financial Anxiety and Stress Among U.S. Households (Highlights) | April 2021

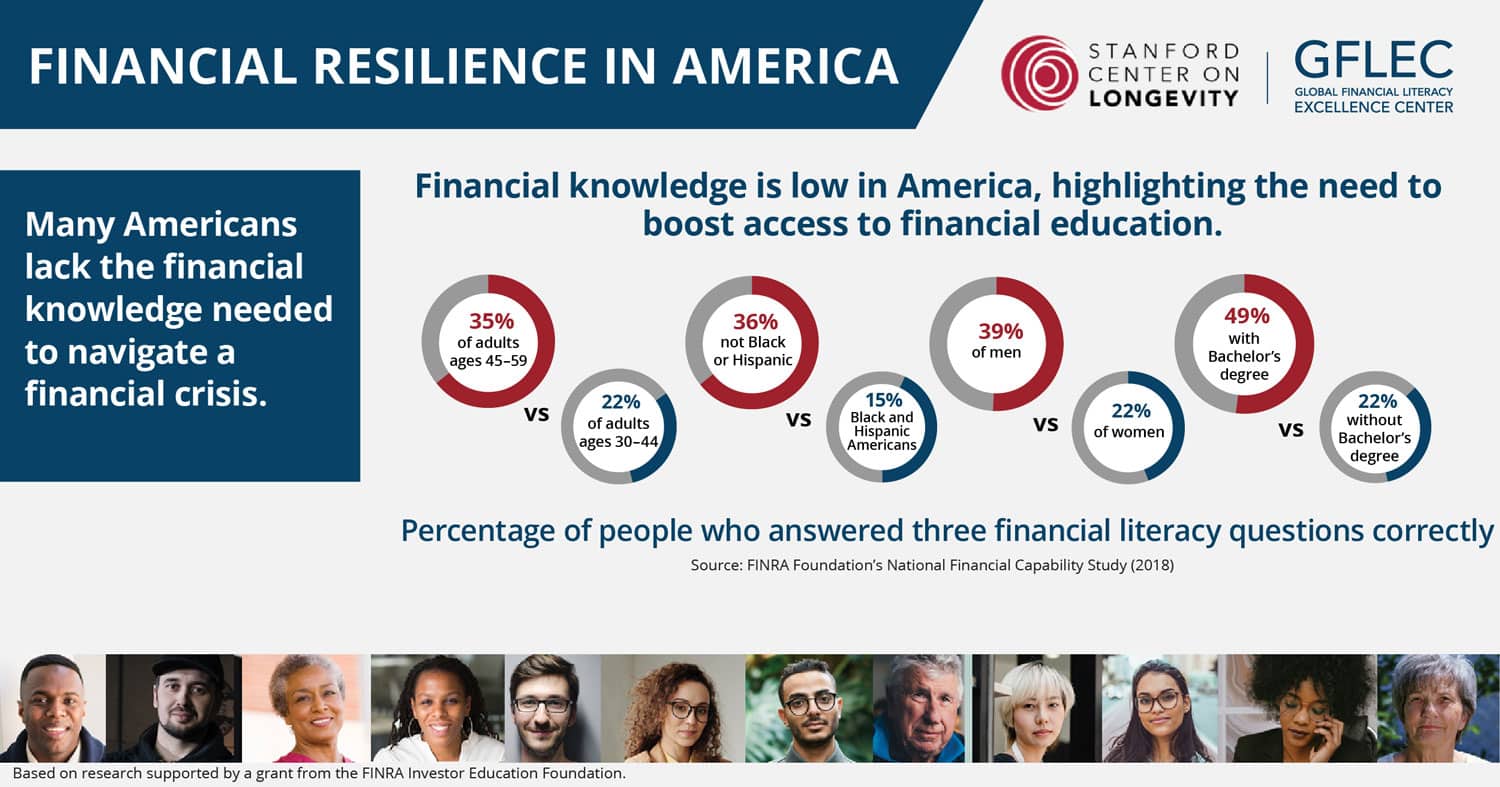

Financial Resilience |

Financial Resilience in America (Report) | August 2021

How to Strengthen Household Financial Resilience (Policy Brief) | August 2021

Financial Fragility |

Financial Fragility in the US: Evidence and Implications | April 2018

Working Paper | Policy Brief | Fact Sheet

The Financial Fragility of American Families | September 2013

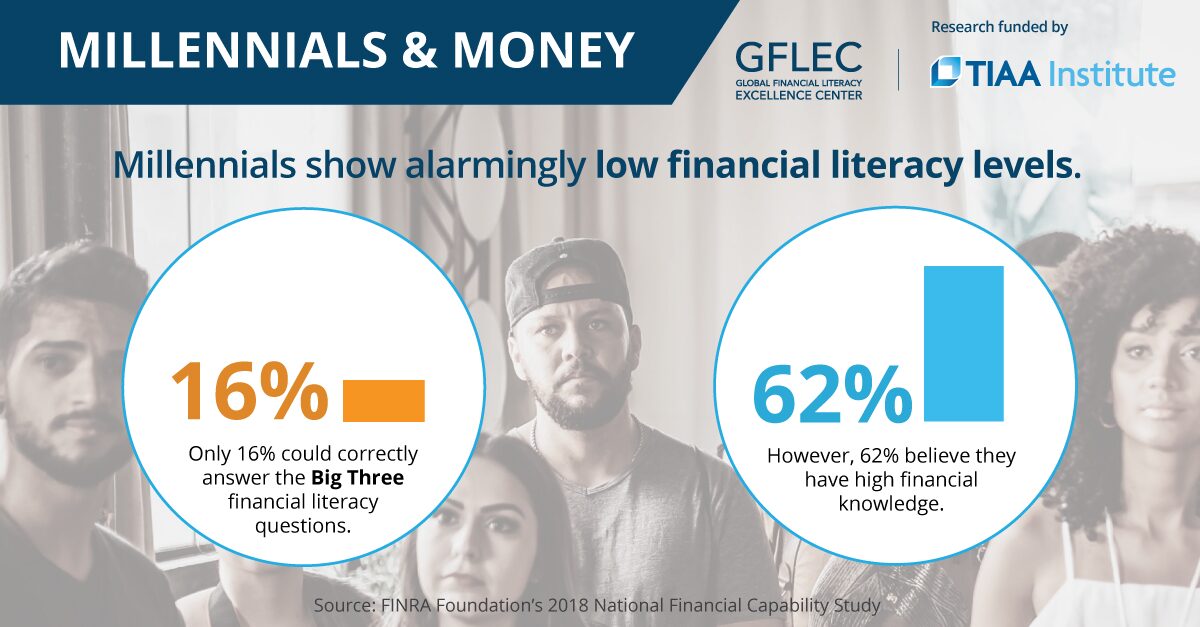

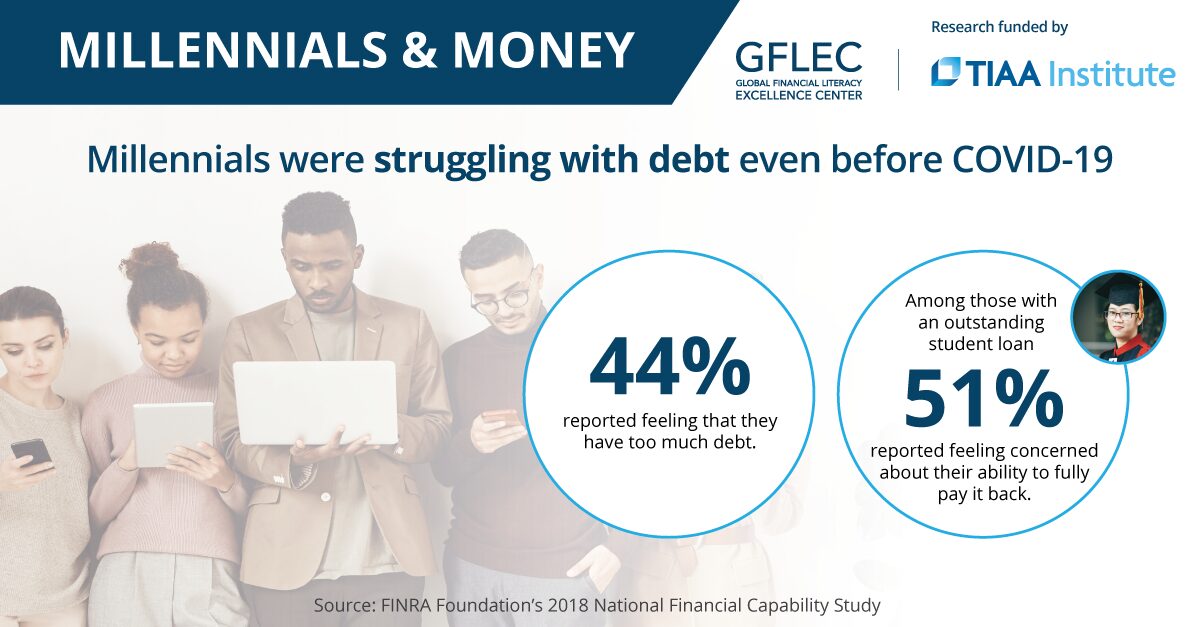

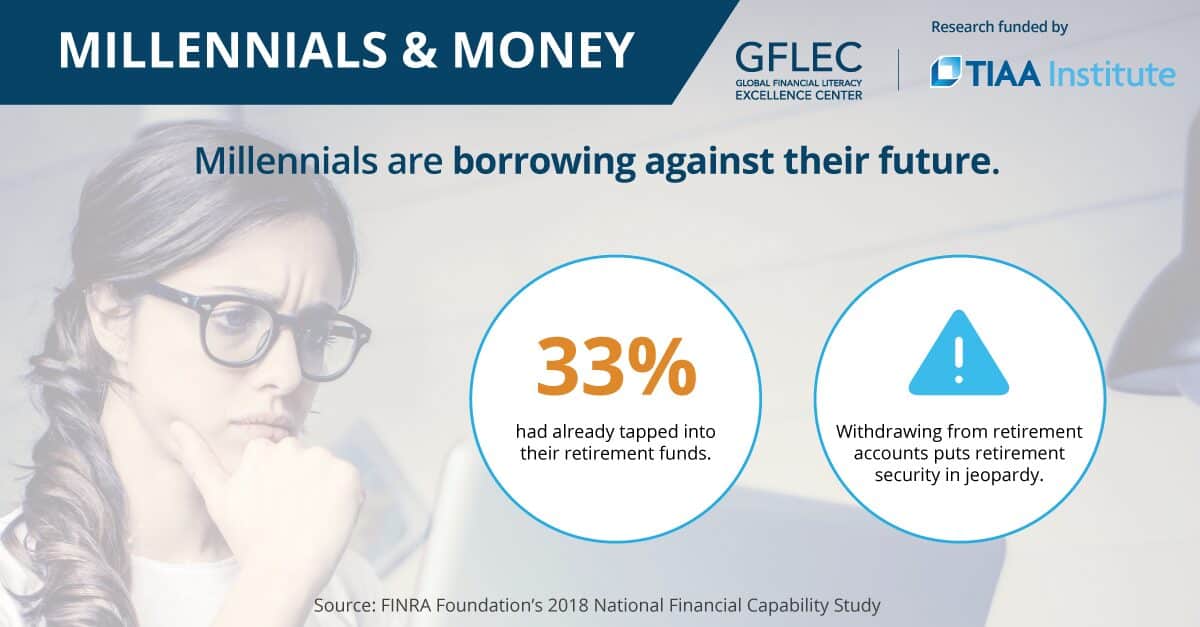

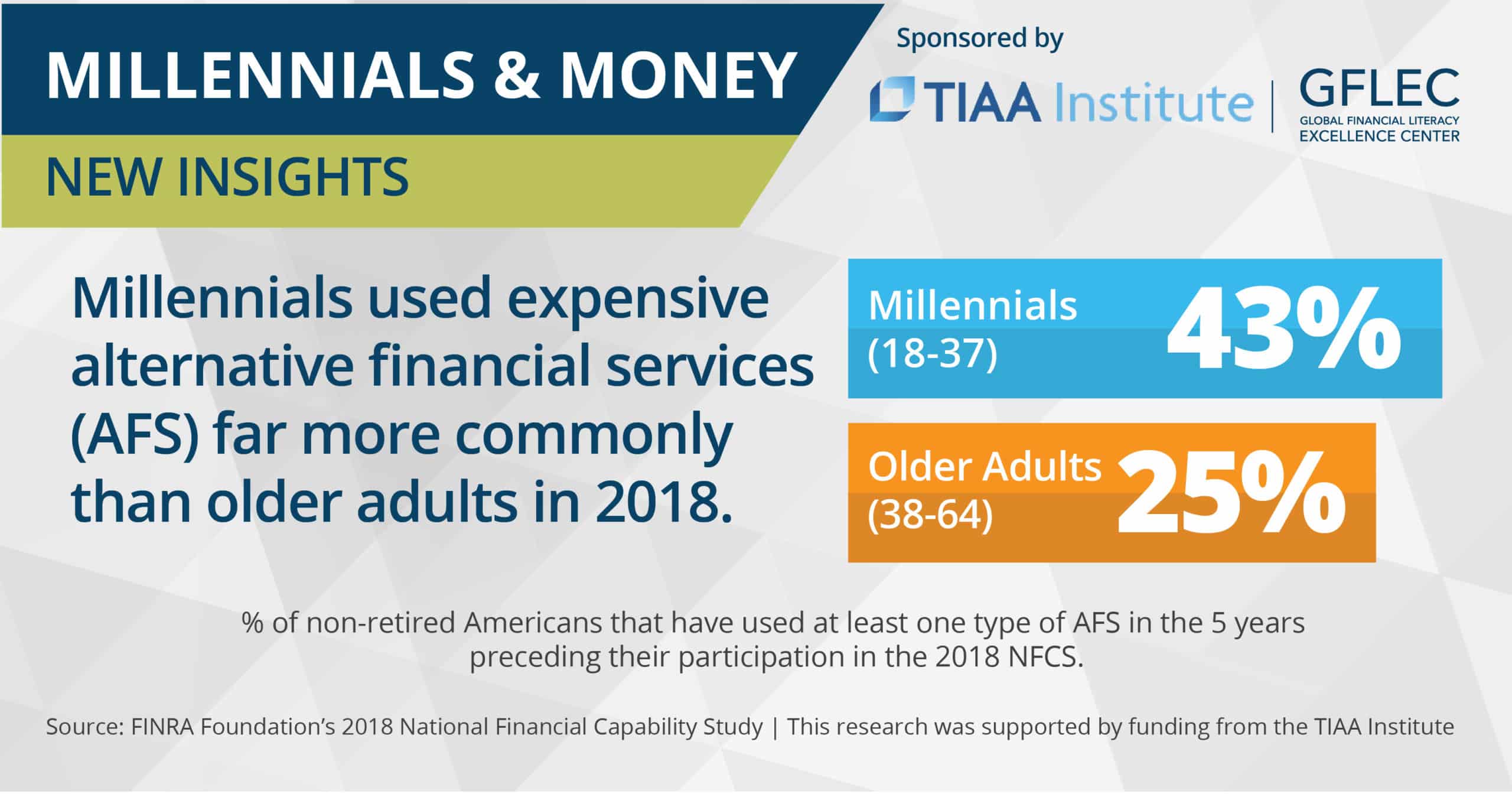

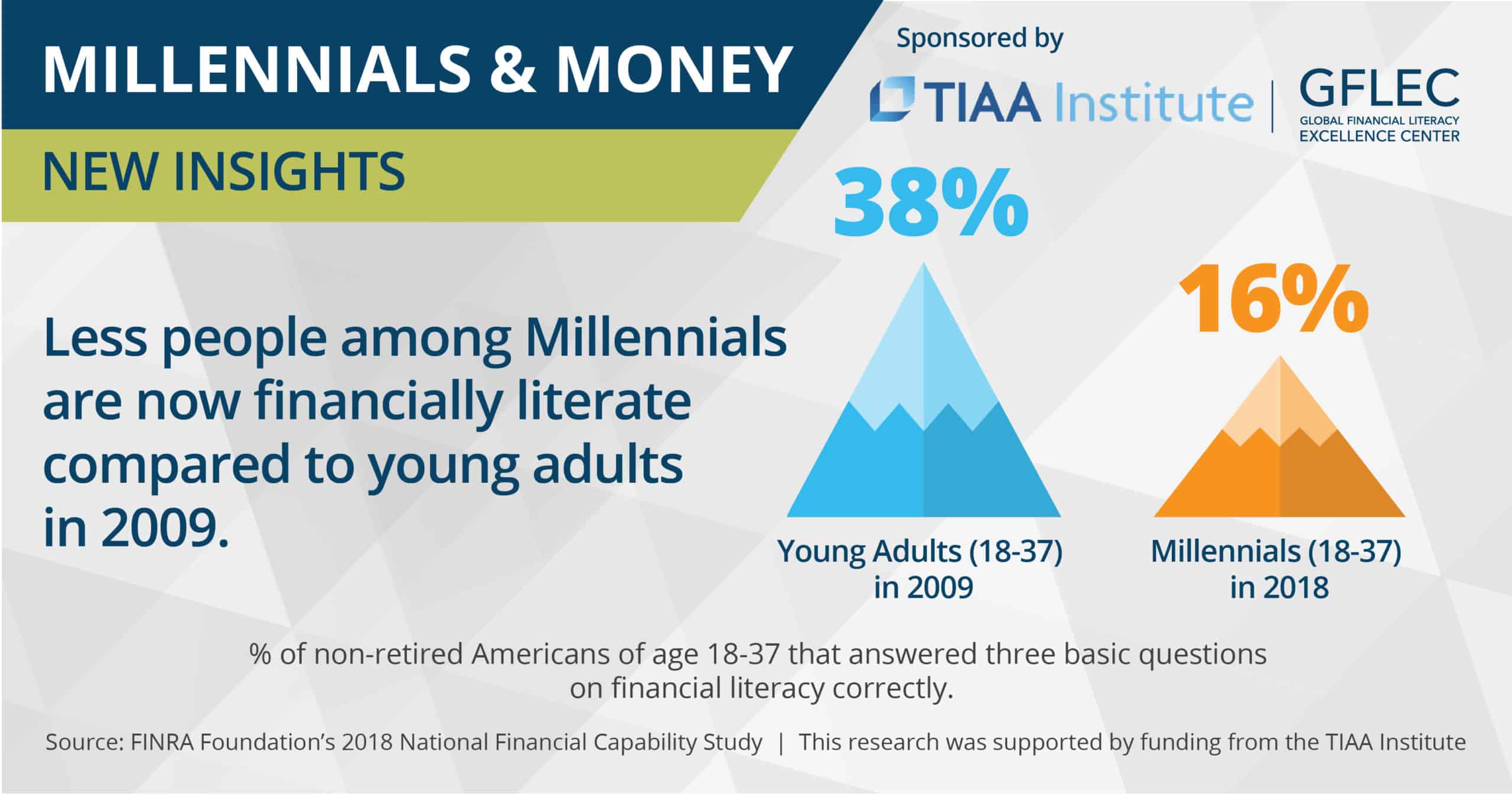

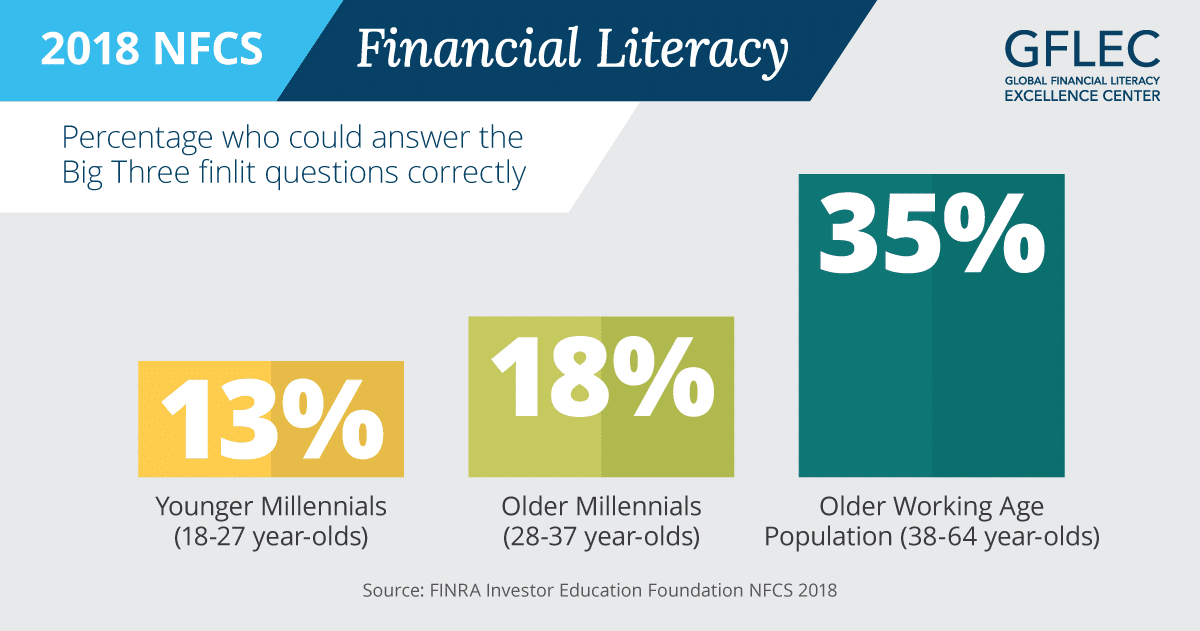

Millennials/Gen Y |

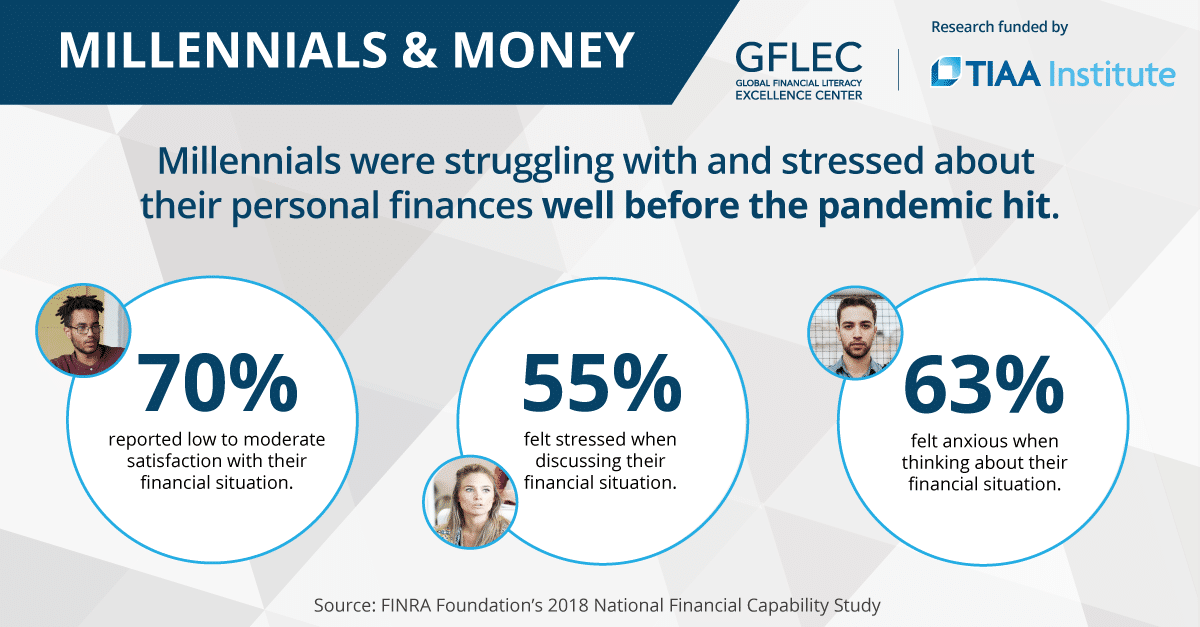

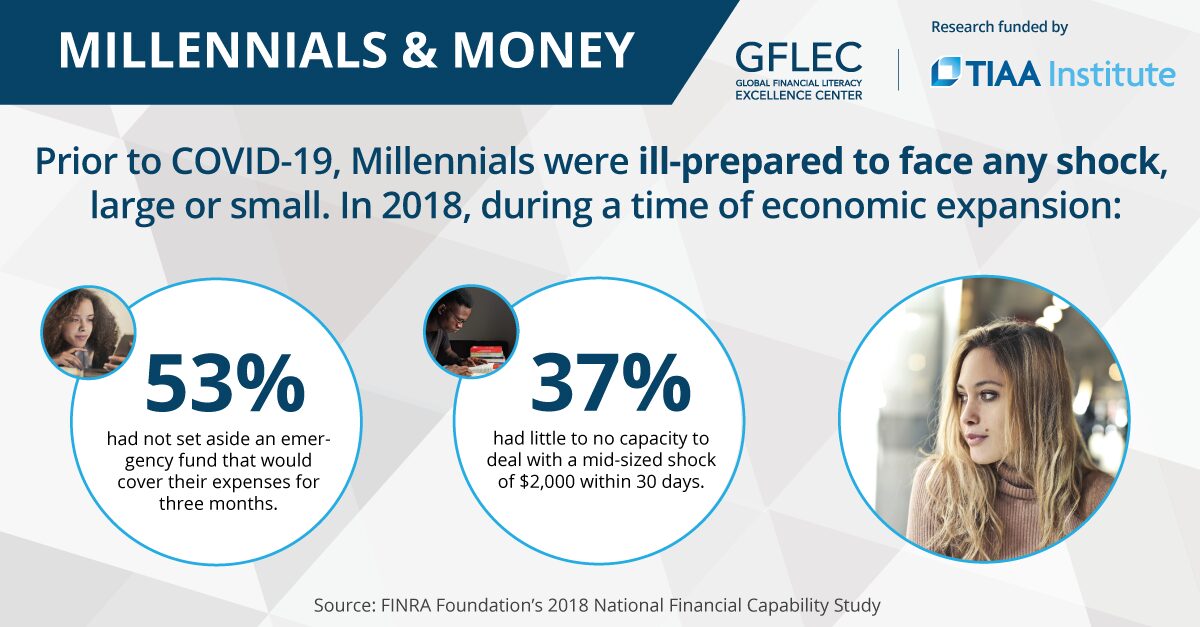

Millennials and Money: Financial Preparedness and Money Management Practices Before COVID-19 | August 2020

Millennials and Money: The State of Their Financial Management and How Workplaces Can Help them | February 2020

Gen Y Personal Finances: A Crisis of Confidence and Capability | May 2014

Helping Gen Y Achieve Long-Term Financial Security | February 2014

Financial Literacy and Financial Behavior among Young Adults: Evidence and Implications | July 2013

Financial Literacy and Quantitative Reasoning in the High School and College Classroom | July 2013

Millennials and Financial Literacy – The Struggle with Personal Finance | 2016

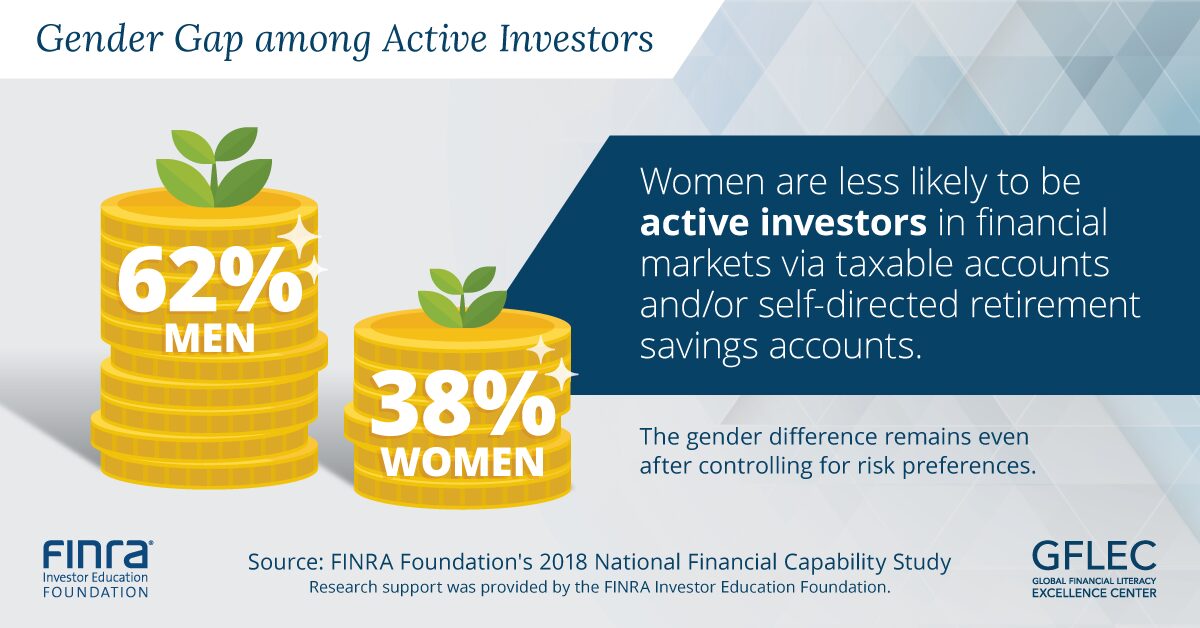

Women |

Financial Well-being among Black and Hispanic Women (Report) | February 2021

Mind the Gap: Women, Men, and Investment Knowledge | March 2020

Older Women’s Labor Market Attachment, Retirement Planning, and Household Debt | August 2016

How Financially Literate are Women? An Overview and New Insights | February 2016

Working Women’s Financial Capability: An Analysis across Family Status and Career Stages | May 2014

Pre-Retirees and Retirees |

Americans’ Troubling Financial Capabilities: A Profile of Pre-Retirees | 2016

Debt and Debt Management among Older Adults | September 2013

Financial Literacy and Retirement Planning in the United States | October 2011

Blacks |

Financial Well-being among Black and Hispanic Women (Report) | February 2021

Others |

Financial Anxiety and Stress Among U.S. Households: New Evidence from the National Financial Capability Study and Focus Groups | April 2021

New Evidence on the Financial Knowledge and Characteristics of Investors | October 2019

Student Loan Debt in the US: An Analysis of the 2015 NFCS Data | November 2016

The Evolution of Consumer Debt Following the Great Recession | September 2016

Optimal Financial Knowledge and Wealth Inequality | September 2015

Financial Literacy and Economic Outcomes: Evidence and Policy Implications | Summer 2015

Financial Literacy: Do people know the ABCs of finance? | April 2015

Risk Literacy | March 2015

Financial Literacy Around the World (FLAT World) | May 2014

The Economic Importance of Financial Literacy: Theory and Evidence | March 2014

The Financial Fragility of American Families | September 2013

The Geography of Financial Literacy | July 2013

Testimony before the Subcommittee on Children and Families of the U.S. Senate Committee on Health, Education, Labor and Pension | April 2013

Financial Literacy and High-Cost Borrowing in the United States | January 2013

Media Highlights

Director Lusardi’s CNBC article about the 2018 data:

It’s Time for Colleges to Require Mandated Financial Literacy Courses

Director Lusardi’s Wall Street Journal blog posts about the 2015 data:

Here’s a Financial Question That Should Worry Everybody

Three Myths About Why People Don’t Plan for Retirement

So Much Student Debt, So Much Ignorance

She also co-authored a Forbes blog post with Gerri Walsh of FINRA Foundation on the findings of the 2015 NFCS:

“A Peek Into America’s Pocketbook Reveals Finances Are Improving Slowly, But Surely.”

Director Lusardi weighed in on PBS News Hour’s segment on savings in the middle class: