Why the Workplace

Holistic financial wellness programs have the power to establish a more satisfied, engaged, and productive workforce. Beyond being an attractive benefit for individual employees, programs that promote financial capability boost workplace engagement and productivity. Many companies are implementing new programs to help employees with their finances. Establishing effective workplace programs will be crucial for employers who want to help their workers and help themselves.

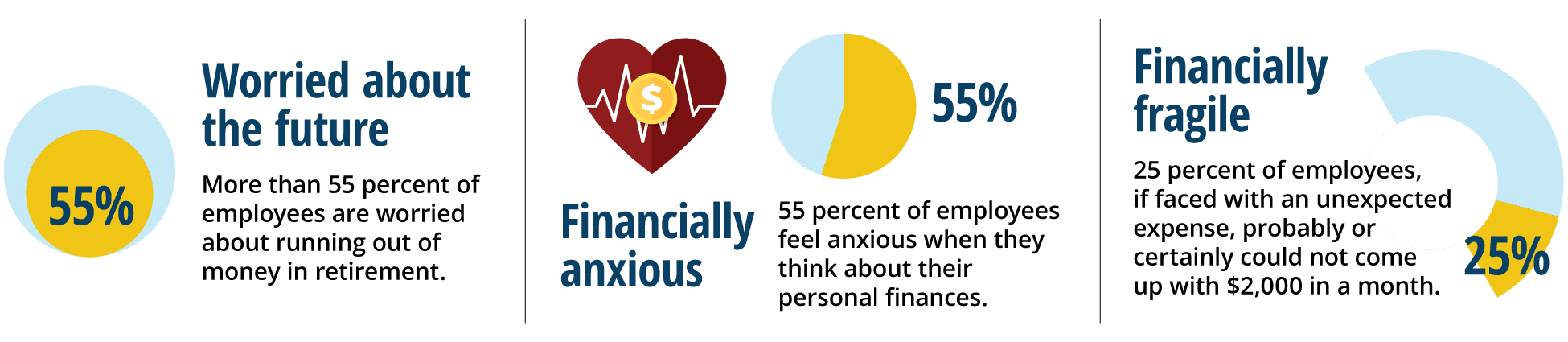

Statistics calculated from the 2018 National Financial Capability Study

The workplace is a natural fit for financial wellness programs, as it creates a mutually beneficial environment of increased engagement and financial security. Crucial financial decisions are made at work every day, and employers can take advantage of financial milestones (e.g., hiring and promotions) to increase their workers’ financial well-being.

Latest Resources

With Employees Receptive to Financial Wellness, Strike While the Iron Is Hot

Employees are looking to get their financial lives in order | Joanne Sammer | May 13, 2021

Boosting Financial Wellness: The Role of Small and Medium-Sized Employers

Connecting to Reimagine: Money & COVID-19 | Webinar | September 22, 2021

This Connecting to Reimagine: Money & COVID-19 webinar, jointly sponsored by the FINRA Investor Education Foundation and GFLEC, looks at recent research findings that highlight financial insecurity among working-age adults and challenges policy makers and small and medium-sized employers to think in new ways about financial wellness benefits.

Tailored Financial Education at the Workplace Matters

GFLEC conducted a Workplace Financial Capability Assessment in collaboration with the Church Pension Group (CPG). The findings highlight the need for financial wellness programs that are tailored to the financial situations and decisions of the employees. In this study, we evaluate the financial capability, money management behavior, and knowledge of CPG members and compare their results to a comparison group from the 2018 National Financial Capability Study (NFCS). Our findings show that CPG members are doing relatively well when compared to the NFCS subsample. However, there is still a concerning degree of financial distress and lack of preparedness when it comes to financial decision-making. Since financial literacy is highly linked to financial outcomes and well-being, these issues could be addressed through tailored education programs.

Financial wellness: What is it? How do we make it happen?

GFLEC organized a roundtable discussion, Financial wellness: What is it? How do we make it happen?, with TIAA Institute on November 15, 2019. Hosted by Roger Ferguson, TIAA president and CEO, and Anuj Mehrotra, dean of the George Washington University School of Business, the roundtable engaged approximately 30 subject matter experts from policy organizations, government, academia, and the private sector. The discussion included a focus on what constitutes financial wellness and how it is best measured and explored essential elements of a holistic financial wellness program that engages across socioeconomic and life stage groups.

The FORTUNE CEO Initiative

Director Lusardi participated as a panelist at the 2019 FORTUNE CEO Initiative Annual Meeting in New York. In the session, “Delivering Economic Inclusion and Investing in Employee Financial Health,” she spoke about the impact and components of effective workplace financial wellness programs. Learn more about the event here.

Partner with Us

Financial wellness doesn’t need to be expensive. Programs can be customized to meet employee needs within a reasonable budget. For example, companies can choose various types of programs, such as educational seminars, online resources, and financial advising in order to promote a happier and financially healthier workplace.

GFLEC has extensive experience consulting with organizations about successful implementation of financial literacy education programs. We have documented our key findings on the effectiveness and best practices for workplace financial wellness.

Consult us to learn how financial wellness programs can help you and your employees!

Our experiment facilities are a great resource for starting your workplace financial initiative!

- Design and implement new financial wellness programs

- Create financial education apps and online tools

- Pilot and evaluate the most promising ideas

- Rely on evidence-based methods

Sample of Our Programs and Initiatives for the Workplace

Additional GFLEC Resources

Information for the Public Sector:

Employees’ Financial Wellness: New Strategies for State-Sponsored Retirement Plans

Presentations

Active vs. Passive Choice in Retirement Savings (at Templeton Investments and Wall Street Journal)

The Effectiveness of Financial Literacy Programs (at Stanford)

Policy Issues for Retirement Investing (at JOIM Conference)

Publications

Defined Contribution Plans and the Challenge of Financial Illiteracy

Reports and Briefs

Financial wellness programs in the workplace: Evidence from a Fortune 25 company

Are your employees in good financial shape? Evidence from a Fortune 25 company

Financial Wellness: What is it? How Do We Make it Happen?

The 2020 TIAA Institute-GFLEC Personal Finance Index

Hispanic Personal Finances: Financial Literacy and Decisionmaking among College-Educated Hispanics

Working Women's Financial Capability

Visual Tools and Narratives: New Ways to Improve Financial Literacy

Helping Gen Y Achieve Long-Term Financial Security

Financial Fragility of American Families

Financial Capability Near Retirement: A Profile of Pre-Retirees

Testimony to ERISA

Testimony to the U.S. Department of Labor ERISA Advisory Council