Financial Literacy and Wellness among African-Americans

New Insights from the Personal Finance (P-Fin) Index

Authors of Recent Report

Paul J. Yakoboski, TIAA Institute

Annamaria Lusardi, GFLEC

Andrea Hasler, GFLEC

Click Here to Read the Executive Summary ➤

About the Survey

The nation’s 44 million African-Americans account for 13% of the U.S. population and have a significant impact on the economy, with $1.2 trillion in purchases annually. Yet the financial well-being of African-Americans lags that of the U.S. population as a whole, and whites in particular. The reasons for these gaps are complex, but one area of importance in addressing them is increased financial literacy. We find that there is a strong link between financial literacy and financial wellness among African-Americans.

This report uses the third wave of the TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) to examine the current state of financial literacy and financial wellness among African-American adults.

Summary of Main Findings

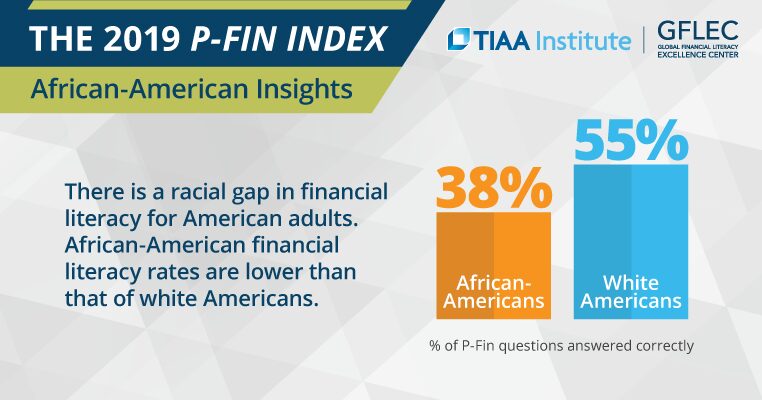

- Personal finance knowledge among African-American adults lags that of whites. On average, African-Americans answered 38% of the P-Fin Index questions correctly, with only 28% answering over one-half of index questions correctly. The analogous figures among whites were 55% and 62%, respectively.

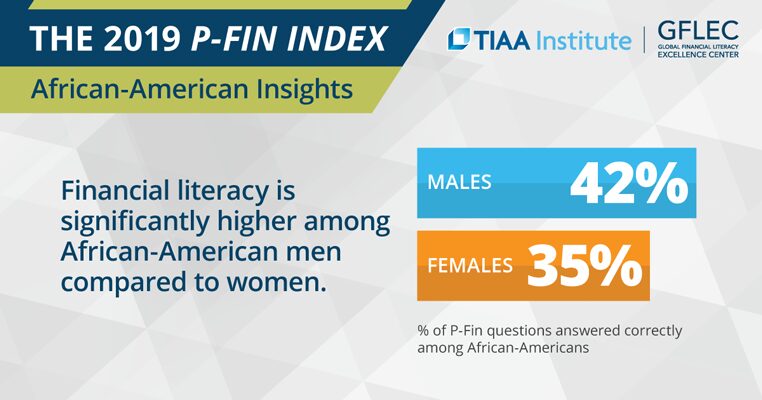

- Financial literacy varies across demographic groups within the African-American population. The observed patterns are consistent with variations identified in the U.S. population as a whole—financial literacy is greater among men, older individuals, those with more formal education, and those with higher incomes.

- Insuring is the functional area where personal finance knowledge is lowest among African-Americans, but it is also essentially just as low in the areas of comprehending risk, investing and identifying go-to information sources.

- Borrowing and debt management is the area of highest personal finance knowledge among African-Americans.

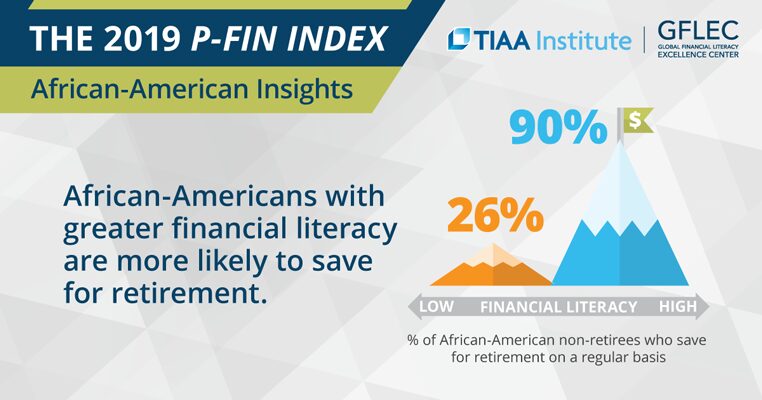

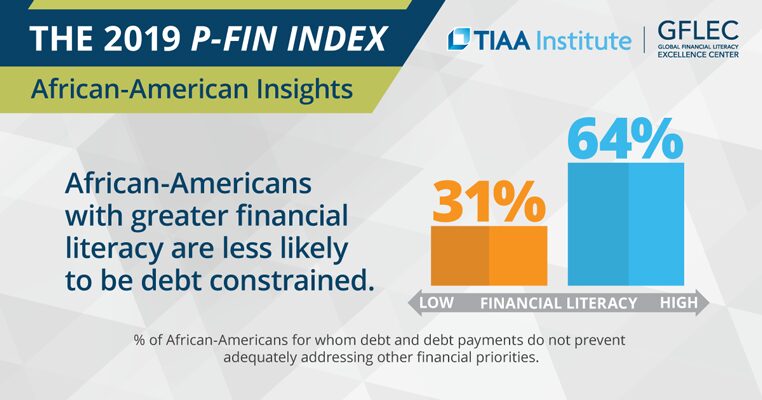

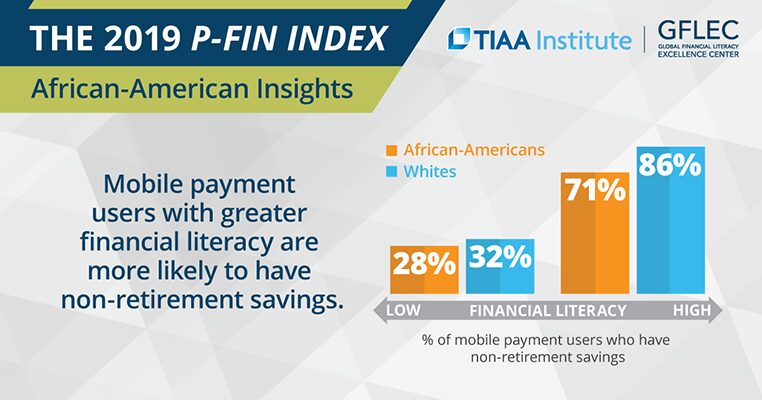

- There is a strong link between financial literacy and financial wellness among African-Americans. Those who are more financially literate are more likely to plan and save for retirement, to have non-retirement savings and to better manage their debt; they are also less likely to be financially fragile.

![]() Our research finds that African-Americans tend to exhibit lower financial well-being than the U.S. white population. Given the strong link between financial literacy and financial well-being, increased financial knowledge can lead to improved financial capability and behaviors.

Our research finds that African-Americans tend to exhibit lower financial well-being than the U.S. white population. Given the strong link between financial literacy and financial well-being, increased financial knowledge can lead to improved financial capability and behaviors.![]()

— Annamaria Lusardi, Academic Director at GFLEC