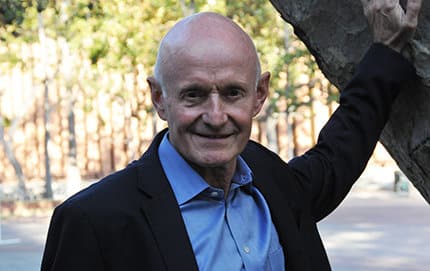

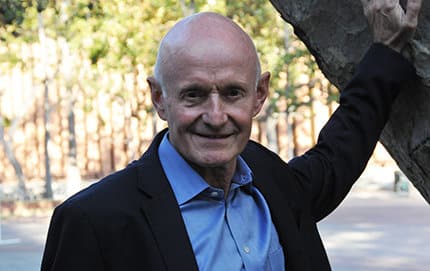

Arie Kapteyn

Professor of Economics, Director, Center for Economic and Social Research, University of Southern California

Professor of Economics, Director, Center for Economic and Social Research, University of Southern California

Arie Kapteyn, Ph.D. is a Professor of Economics and the Executive Director of the Dornsife College of Letters Arts and Sciences Center for Economic and Social Research (CESR) at the University of Southern California. Before founding CESR at USC in 2013, Prof. Kapteyn was a Senior Economist and Director of the Labor & Population division of the RAND Corporation.

Much of Prof. Kapteyn’s recent applied work is in the field of aging and economic decision making, with papers on topics related to retirement, consumption and savings, pensions and Social Security, disability, economic well-being of the elderly, and portfolio choice. He is a pioneer in the development of new methods of data collection, using the Internet and mobile devices.

Dr. Kapteyn received an M.A. in econometrics from Erasmus University Rotterdam, an MA in agricultural economics from Wageningen University, and a Ph.D. from Leiden University, all in the Netherlands.

This paper documents consumers’ difficulty valuing life annuities. We show that the prices at which people are willing to buy annuities are substantially below the prices at which they are willing to sell them, a finding we show is not attributable to an endowment effect. We also find that buy values are negatively correlated with sell values and that the sell-buy valuation spread is negatively correlated with cognition; the spread is larger for those with less education, weaker numerical abilities, and lower levels of financial literacy. Our evidence contributes to the emerging literature on heterogeneity in financial decision-making abilities.