Financial literacy and well-being in a five generation America

The 2021 TIAA Institute-GFLEC Personal Finance Index

Authors of Recent Report

Paul J. Yakoboski, TIAA Institute

Annamaria Lusardi, GFLEC

Andrea Hasler, GFLEC

Click Here to Read the Report ➤

Click Here to Read the Press Release ➤

About the Survey

With five years of the Gen Z cohort now over age 18, the U.S. adult population spans five generations. This report uses data from the 2021 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) to compare financial literacy across the Silent Generation, the Baby Boom Generation, Gen X, Gen Y (millennials) and Gen Z at this point in time. How well individuals navigate financial decisions throughout their lifetime depends, at least in part, on their financial literacy.

The P-Fin Index is a long-term project that annually assesses financial literacy among American adults. Gen Z was quota-sampled when fielding the 2021 P-Fin Index survey which enables comparisons with the other generations, as well as a closer examination within the Gen Z adult population. The P-Fin Index survey also includes indicators of financial wellness along several dimensions and those too are examined across generations and within Gen Z.

Summary of Main Findings

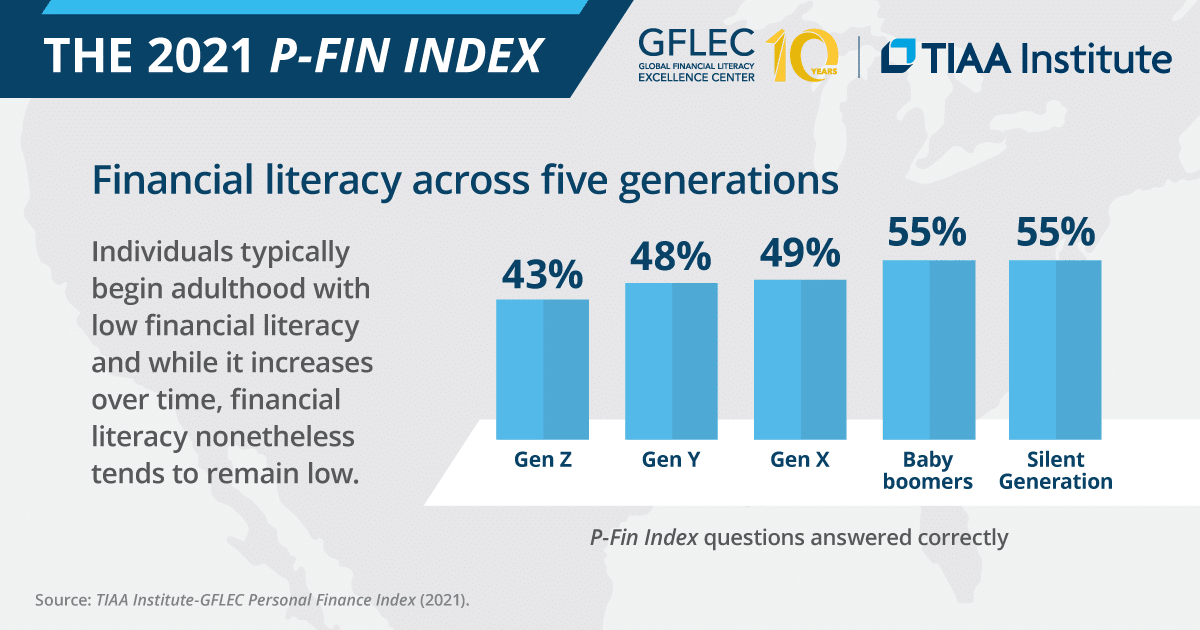

- Financial literacy tends to be low within each of the five generations, but particularly so among Gen Z. Two-thirds of Gen Z could answer only 50% or less of the index questions correctly. By comparison, approximately 40% of baby boomers and the Silent Generation correctly answered no more than 50% of the questions. These findings indicate that individuals typically begin adulthood with low financial literacy and while it increases over time, financial literacy nonetheless tends to remain low.

- Within Gen Z, financial literacy tends to be lowest among those who have never attended college (currently or previously)—on average, they correctly answered 39% of the index questions. Current students and non-students who previously attended college tend to have the same level of financial literacy, the former correctly answered 43% of the P-Fin Index questions, on average, and the latter 45%.

- The P-Fin Index also enables nuanced analysis of financial literacy across eight functional areas. Functional knowledge tends to be greatest across generations in the areas of borrowing and saving. With that said, financial literacy in those two areas tends to be lower earlier in the lifecycle, particularly among Gen Z. At the other end of the spectrum, functional knowledge in the realm of insuring tends to be particularly low among Gen Z and Gen Y. For Gen Z, it is the area of lowest financial literacy.

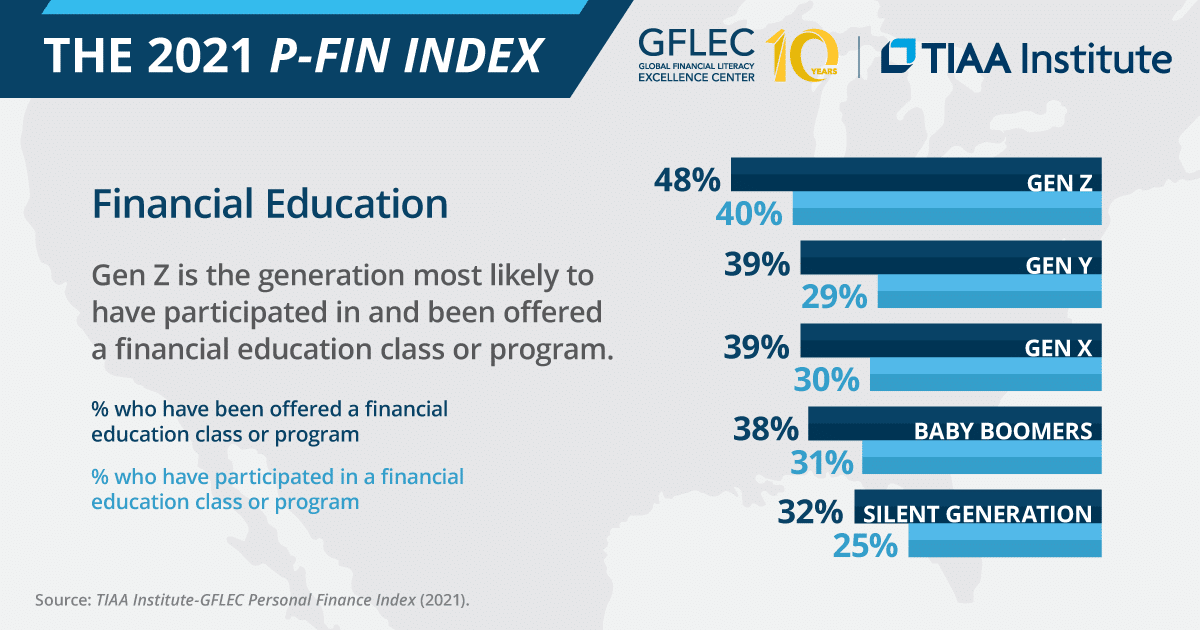

- Gen Z is the generation most likely to have participated in a financial education class or program (40%); they are also the generation most likely to have been offered a financial education class or program (48%). Given that Gen Z adults are currently age 18 to 23, this indicates that financial education programs have become more common in secondary and higher education.

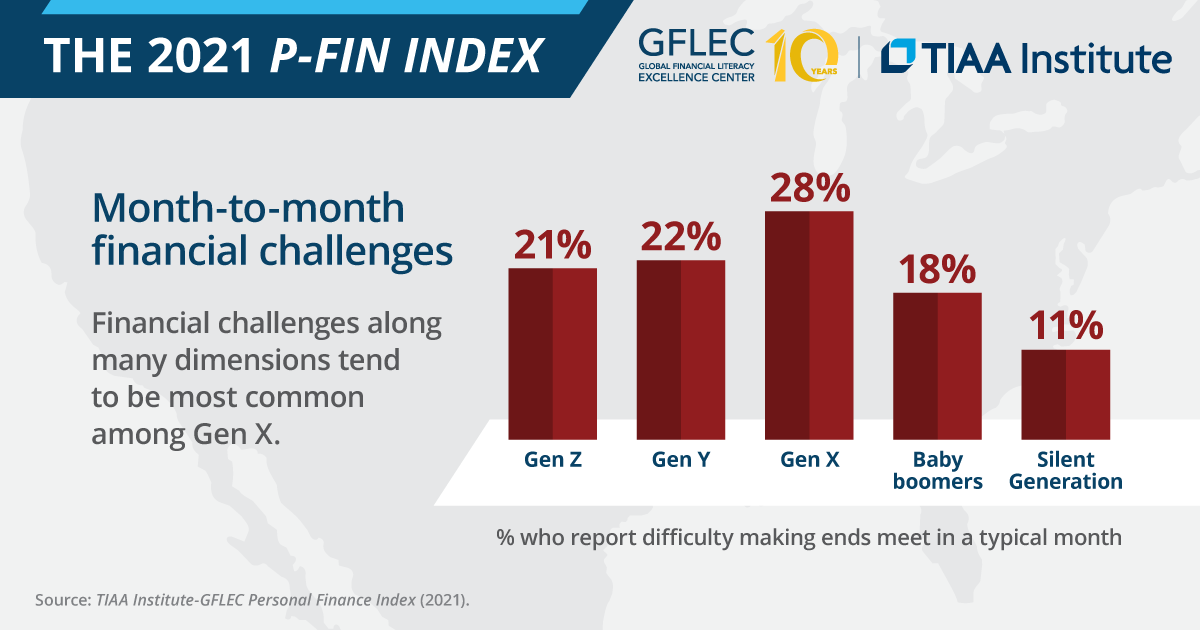

- The 2021 P-Fin Index data clearly depict the financial struggles that exist for many Americans. Examining the financial wellness indicators across generations reveals that financial challenges along many dimensions tend to be most common among Gen X. For example, 28% of Gen X report difficulty making ends meet in a typical month. The analogous figure is approximately 20% among Gen Z, Gen Y and baby boomers and 11% among the Silent Generation.

- Within Gen Z, financial challenges tend to be more common among those who have never attended college (currently or previously) than current students and non-students who previously attended college.

- The P-Fin Index has consistently found that financial wellness is linked to financial literacy and this holds across the five generations as well. Differences in financial wellness between those with relatively high and those with relatively low financial literacy tend to be most pronounced among Gen Y.

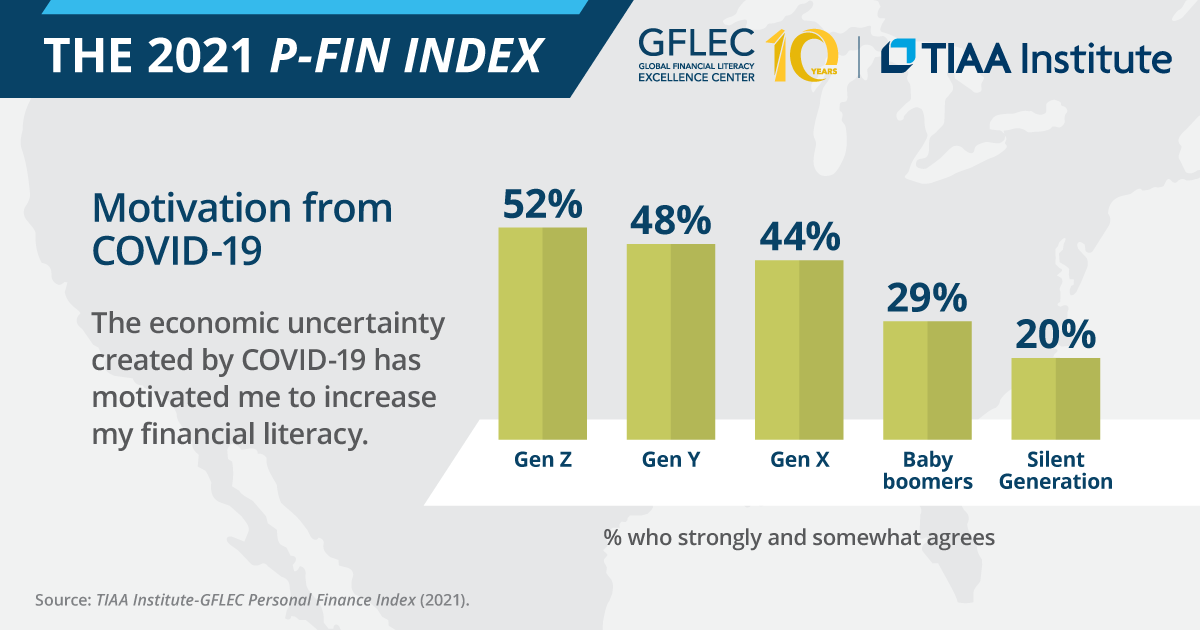

- While 39% of Americans say that the economic uncertainty created by COVID-19 has motivated them to increase their financial literacy, this feeling is significantly more common among Gen Z (52%), Gen Y (48%) and Gen X (44%) compared with baby boomers (29%) and the Silent Generation (20%).

![]() The number of Americans who lack financial literacy, particularly in our younger generations, is deeply concerning. Until financial education is offered in schools, institutions of higher education, and workplaces, we will continue to see generations of adults struggling with their personal finances.

The number of Americans who lack financial literacy, particularly in our younger generations, is deeply concerning. Until financial education is offered in schools, institutions of higher education, and workplaces, we will continue to see generations of adults struggling with their personal finances.![]()

— Annamaria Lusardi, Academic Director at GFLEC