Financial Literacy and Wellness Among U.S. Women

Insights on Underrepresented Minority Women

Authors of Recent Report

Paul J. Yakoboski, TIAA Institute

Annamaria Lusardi, GFLEC

Andrea Hasler, GFLEC

Click Here to Read the Report ➤

About the Survey

The 2020 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index) survey was fielded in January 2020 and included an oversample of women. This enables examining the state of financial literacy and financial wellness among U.S. women immediately before the onset of COVID-19. A more refined understanding of financial literacy among women, including areas of strength and weakness and variations among subgroups, can inform initiatives to improve financial wellness, particularly as the United States moves forward from the pandemic and its economic consequences.

Summary of Main Findings

- Financial literacy is low, women are ill-prepared for the current crisis

- Financial literacy is low among U.S. adults in general, including women. Women correctly answered only 49% of the 2020 P-Fin Index questions.

- Comprehending risk and uncertainty is the area of lowest financial literacy among women.

- Low financial literacy, especially with regards to risk and uncertainty, means that individuals are particularly ill-positioned to make appropriate financial decisions in an environment of crisis like the current one.

- Gender gap in financial literacy

- There exists a gender gap in financial knowledge. Financial literacy tends to be lower among women than among men.

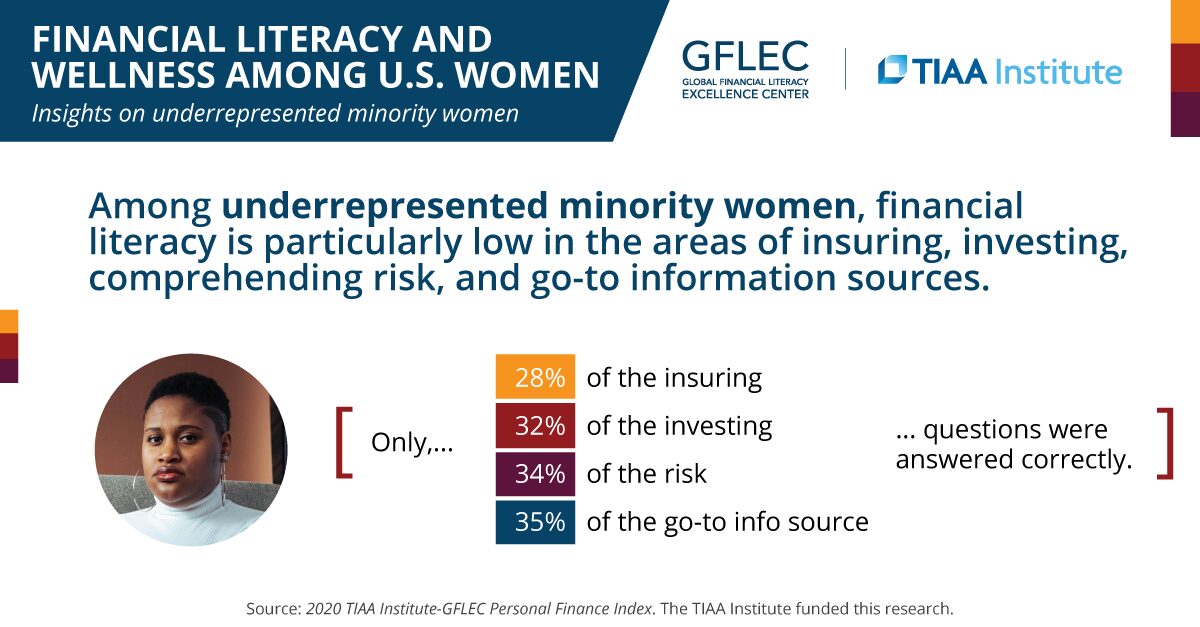

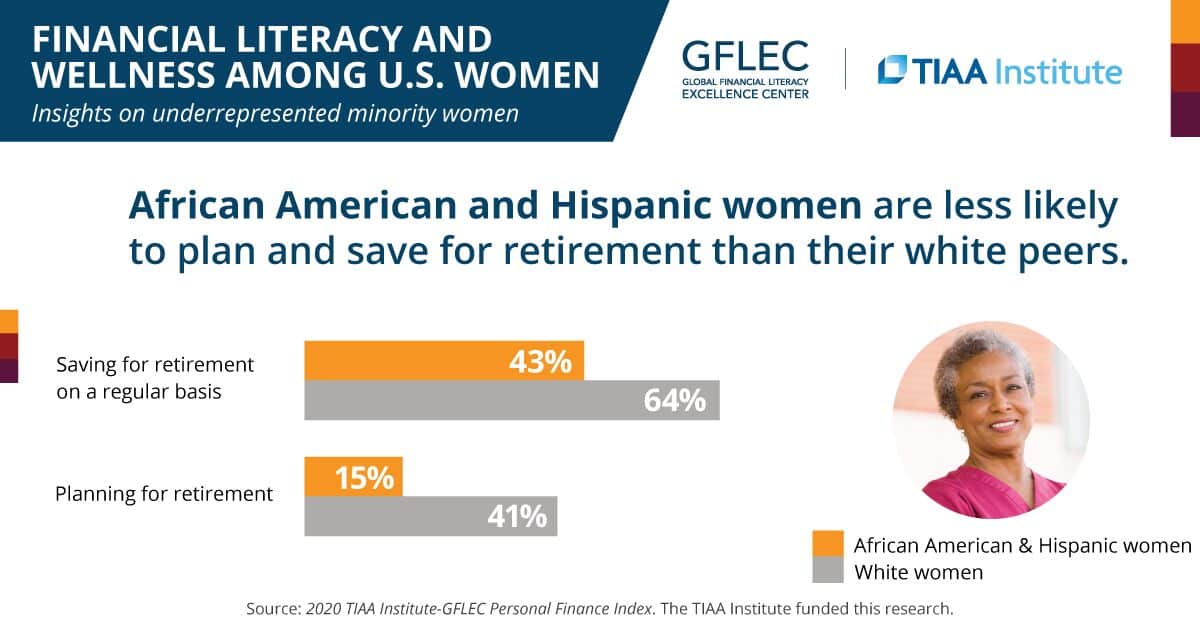

- Financial literacy is lowest among underrepresented minority women

- Personal finance knowledge tends to be lower among underrepresented minority women—African American and Hispanic women—compared with their white peers.

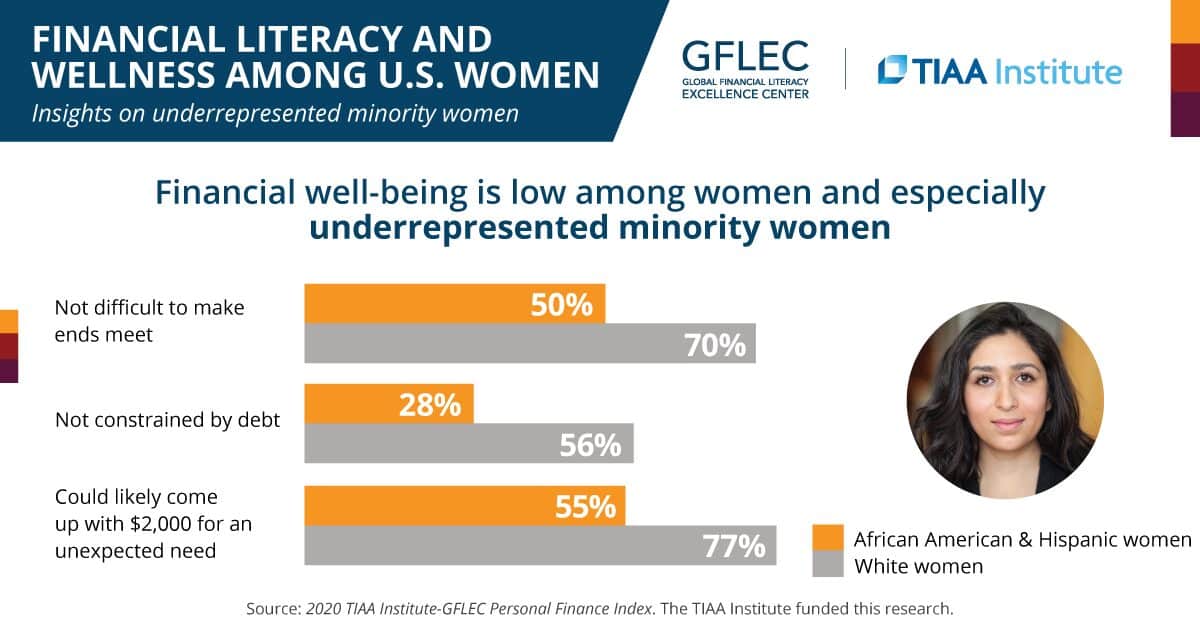

- Financial well-being is low among women and especially underrepresented minority women

- For each indicator of financial wellness in the P-Fin Index survey, there is a significant gap between underrepresented minority women and their white peers.

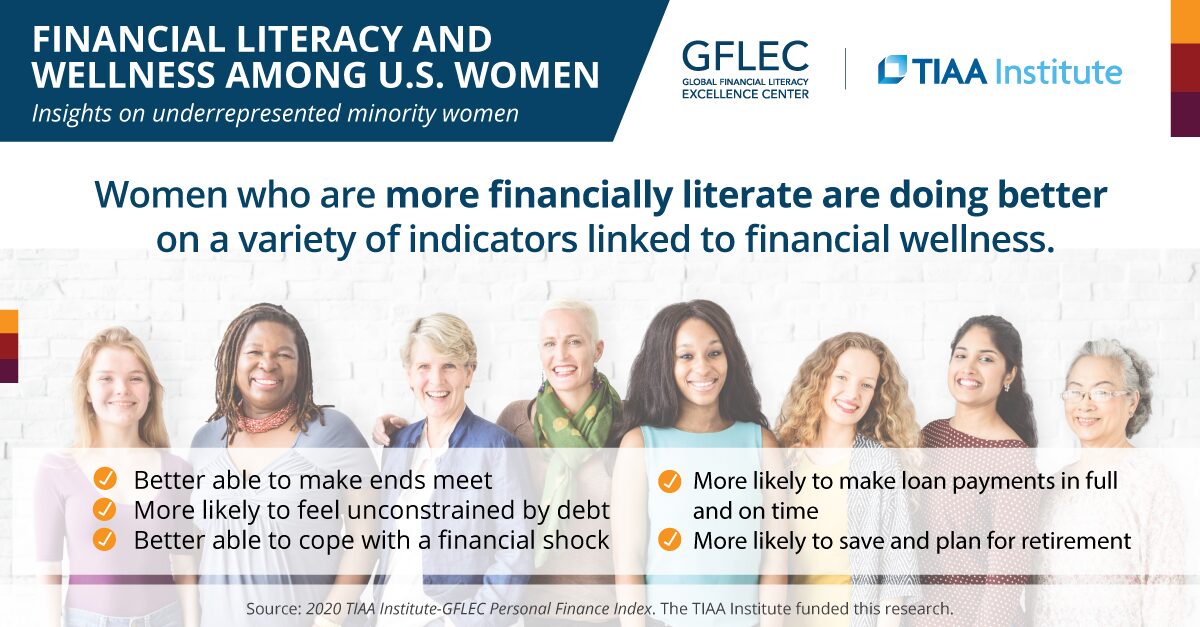

- There is a strong link between financial literacy and well-being

- Financial wellness tends to be greater among women with higher levels of financial literacy.

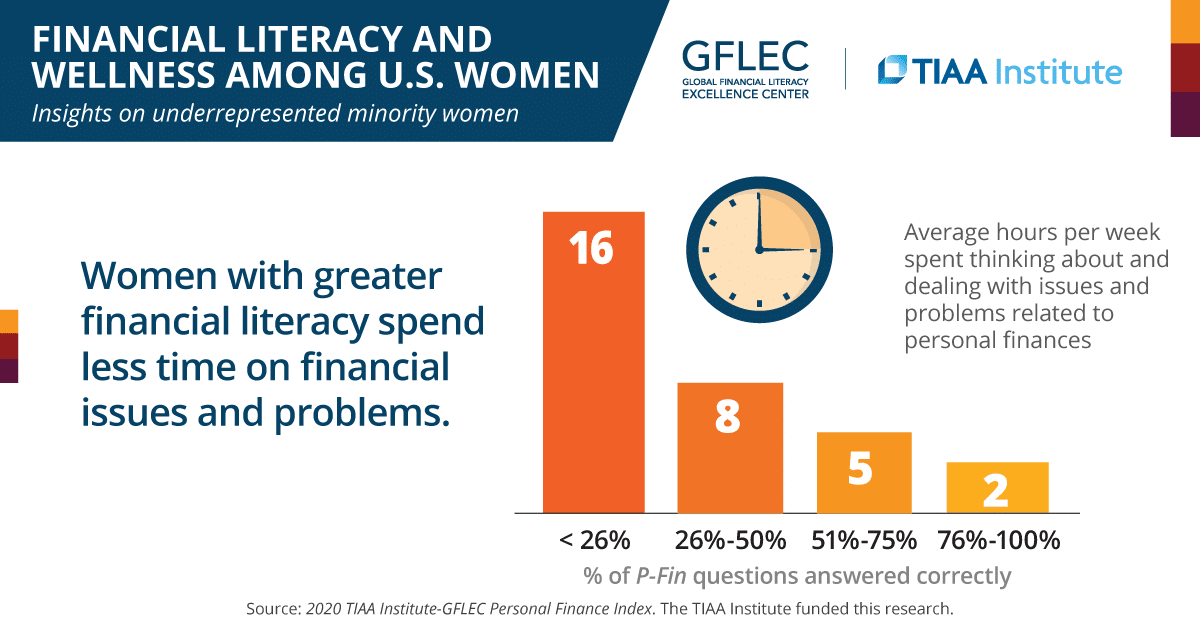

- Women with higher levels of financial literacy tend to spend less time on personal finance issues and problems.

- Greater financial literacy is associated with greater financial wellness also among underrepresented minority women.

- This implies that those with greater financial literacy are better positioned along various dimensions to weather adverse economic conditions such as those that exist today.

![]() The 2020 P-Fin Index findings about women, particularly underrepresented women, are alarming. They signal an urgent need for policymakers, private-sector leaders, and others to develop policies and programs that empower women. Without financial education interventions, the inequities we found in this study will become even more severe.

The 2020 P-Fin Index findings about women, particularly underrepresented women, are alarming. They signal an urgent need for policymakers, private-sector leaders, and others to develop policies and programs that empower women. Without financial education interventions, the inequities we found in this study will become even more severe.![]()

— Annamaria Lusardi, Academic Director at GFLEC