WHEN WILL THE PENNY DROP?

Money, financial literacy and risk in the digital age

Evidence from Ten European Countries

About the Survey

In November 2016, Allianz, in collaboration with Director Annamaria Lusardi, surveyed a total of 10,000 (approximately 1,000 people in each country) in the western European countries of Austria, Belgium, France, Germany, Italy, the Netherlands, Portugal, Spain, Switzerland, and the United Kingdom to better understand their financial and risk literacy and financial decision making. The relationship between financial literacy and relevant financial outcomes (borrowing and investing behavior and planning and saving for retirement) is well documented in the academic literature. This current study goes further by adding questions relating to risk concepts. It also examines the extent to which people who have a good understanding of financial and risk concepts are also better at recognizing the right financial product for a specific financial need in real-life situations.

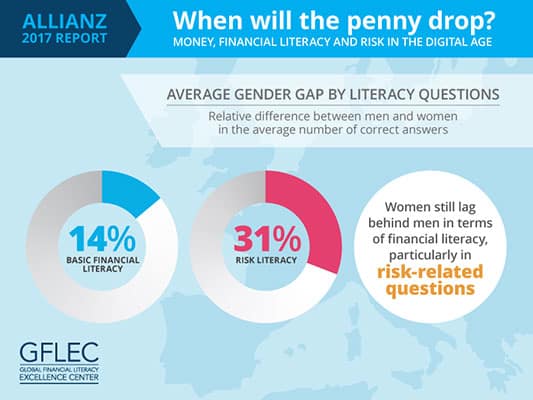

The results of the survey show low financial and risk literacy levels across all countries. Concepts related to risk are particularly difficult for people to grasp; many respondents indicated they did not know the answer to the risk literacy questions. The analysis of the three financial scenarios yielded the same sobering results as the findings about the financial and risk literacy questions. A quarter of Europeans were unable to identify the correct financial solutions to even one of the three stated scenarios. Most important, the data show that people with a good grasp of financial and risk concepts are twice as likely as those without to make better financial decisions. Women and Millennials are particularly at risk of making poor financial decisions.

Summary of Main Findings

- More than ten years and a financial crisis after the first waves of financial literacy surveys, the results of this study confirm little has changed.

- Austria, Germany, and Switzerland top the ranking in financial and risk literacy, while France, Portugal, and Italy rank at the bottom, although similar patterns exist between countries.

- Risk-related concepts are the most difficult to grasp in all countries and are the least understood, especially the concept of risk diversification.

- Women still lag behind men in terms of financial literacy, particularly in risk-related questions.

- A university degree does not automatically make someone a financial expert—although it helps.

- Millennials (under 35) have the lowest financial and risk literacy, though this may change later in life.

- Overall, people make poor financial decisions when set in real-life context.

- Longevity risk is the easiest to grasp: elderly respondents performed better than younger ones; still 40% gave the wrong answer.

- Diversification risk is the most difficult to understand: Only 28% of respondents Europe-wide could identify the most suitable financial product.

- People with a good grasp of financial and risk concepts are twice as likely as those without to make better financial decisions.

![]() Financial literacy is an essential skill to thrive in today’s changing economic environment. This is particularly the case for European countries, which are facing low interest rates and new financial and pension products and labor markets. Dealing with the changing nature of this situation requires lifelong learning.

Financial literacy is an essential skill to thrive in today’s changing economic environment. This is particularly the case for European countries, which are facing low interest rates and new financial and pension products and labor markets. Dealing with the changing nature of this situation requires lifelong learning.

It is particularly important to have accurate information about financial literacy to better serve the needs of different groups of the population and also design programs, products and policies that are evidence-based.![]()

— Annamaria Lusardi