Millennial Mobile Payment Users:

A Look into their Personal Finances and Financial Behaviors

Authors

Carlo de Bassa Scheresberg, GFLEC, The George Washington University School of Business

Andrea Hasler, GFLEC, The George Washington University School of Business

Annamaria Lusardi, GFLEC, The George Washington University School of Business

About the Research

The study examines data from two surveys—the 2015 National Financial Capability Study and the 2016 GFLEC Mobile Payment Survey—to provide insights on the financial capability of American Millennials who use mobile payments.[1]

Highlights

Summary of our Findings

- Millennials who use mobile payments more often are male, are employed, have higher levels of education, and have higher incomes than non-users. They are also more often of minority ethnicity.

- Millennials who use mobile payments are more likely to use a variety of financial products. However, they are also more likely to hold nearly every form of debt noted on the surveys, including auto loans, student loans, and home equity loans.

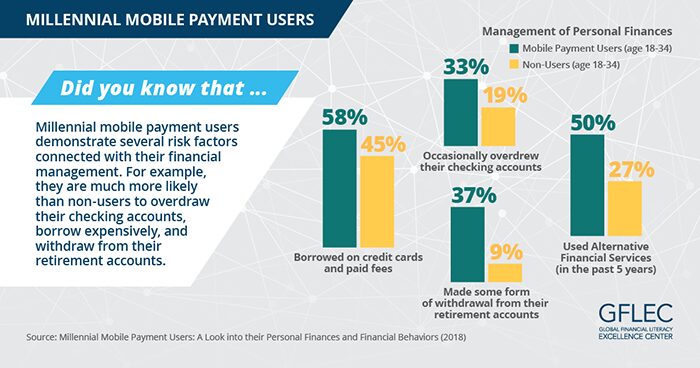

- Despite reporting higher income and higher education levels, the data show that Millennials who use mobile payments are at a greater risk of experiencing financial distress and engaging in financial mismanagement.

- The findings suggest that mobile payment services are attracting segments of customers who have a range of needs that go beyond the convenience provided by monetary transactions. These needs—for example, help in dealing with short-term debt or minimizing fees—represent opportunities for innovation that can be targeted by fintech developers.

- Compared to non-users, Millennials who use mobile payments are more likely to report that

- they occasionally overdraw their checking account (33% vs. 19%)

- they paid fees on their credit cards in the past 12 months (58% vs. 45%)

- they made withdrawals from their retirement account (37% vs. 9%)

- they used alternative financial services such as pawnshops or payday loans (50% vs. 23%)

- Empirical analysis shows that mobile payment usage is positively associated with poor financial management practices even after accounting for several socio-demographic characteristics. For example, those who use mobile payments are nearly 16 percentage points more likely to overdraw their checking account and 23 percentage points more likely to turn to alternative financial services.

“Using data from two surveys, we find striking differences in the financial capability of Millennial mobile payment users versus individuals who do not use mobile payments. Those who use mobile payments show lower levels of financial literacy and worse financial management practices than non-users.”

— Annamaria Lusardi

[1] The study defines mobile payment users as those who use their mobile phone to “pay for a product or service in person at a store, gas station, or restaurant (e.g., by waving/tapping your mobile phone over a sensor at checkout, scanning a barcode or QR code using your mobile phone, or using some other mobile app at checkout).”