Millennial Financial Literacy and Fin-tech Use:

Who Knows What in the Digital Era

New Insights from the 2018 P-Fin Index

Authors of Recent Report

Paul J. Yakoboski, TIAA Institute

Annamaria Lusardi, GFLEC

Andrea Hasler, GFLEC

About the Survey

Using an oversample of Gen Y in the 2018 wave of the TIAA Institute-GFLEC Personal Finance Index (P-Fin Index), this report examines the financial literacy of millennials and how they engage with fin-tech, i.e., use smartphones for financial purposes.

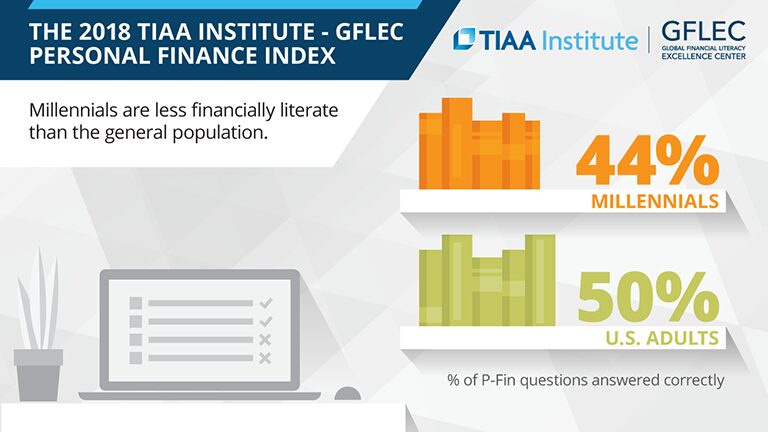

We find that there is a Gen Y financial literacy gap—on average, millennials answered 44% of the P-Fin Index questions correctly, while the U.S. adult population answered 50% correctly. We also examine the use of smartphones for making payments and tracking expenses. These fin-tech activities are not linked to better financial management; those who use mobile payments are more likely to overdraw their checking account, and those who use their smartphone to track spending are not doing better in this regard than those who do not.

Summary of Main Findings

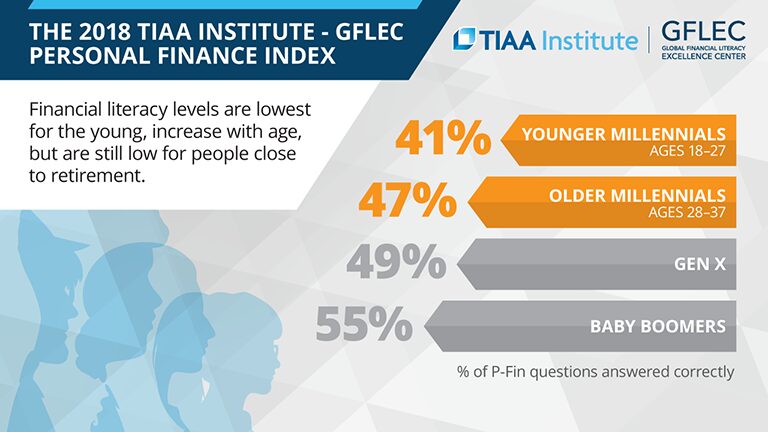

- Millennials answered 44 percent of P-Fin Index questions correctly, compared to 50 percent of the US adult population. Moreover, younger millennials (ages 18-27) answered 41 percent of P-Fin Index questions correctly, compared to 47 percent of older millennials (ages 28-37).

- Financial literacy among both younger and older millennials is lowest in the areas of comprehending risk and insuring. Insuring is a point of weakness in particular for younger millennials; it is the area in which their gap in financial literacy is greatest compared to older millennials.

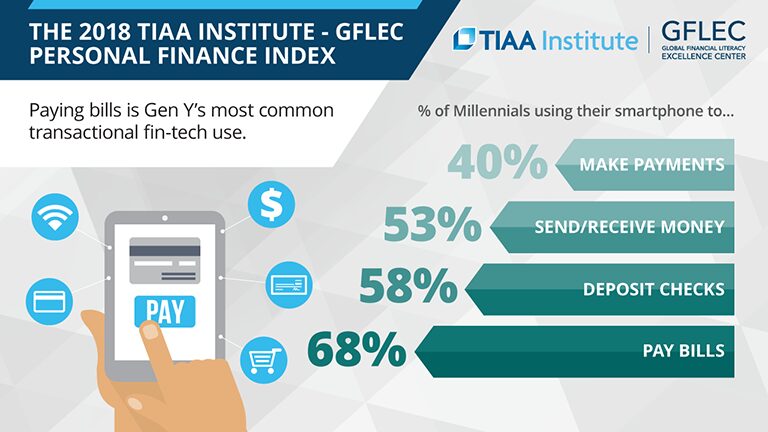

- Approximately 80 percent of millennials use their smartphone for transactional purposes like paying bills and depositing checks, and 90 percent use their phones for informational activities like tracking their spending.

- While most millennials use their smartphones to manage their personal finances, financial technology (fin-tech) does not necessarily improve their personal finance management practices.

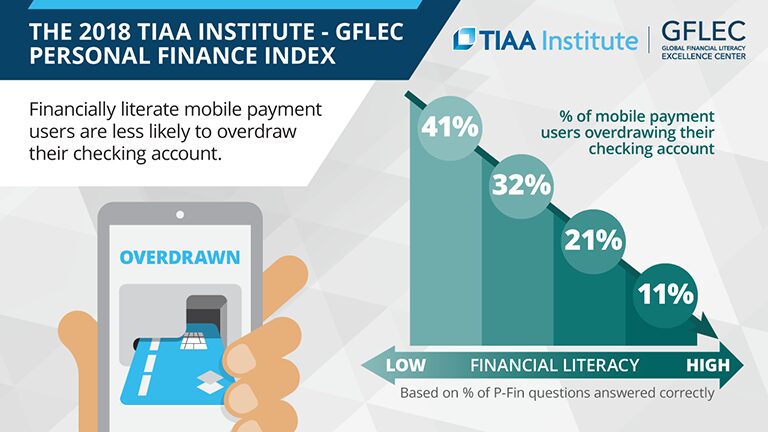

- Almost 30 percent of millennials who use their smartphone to make mobile payments report overdrawing their checking account, compared with 20 percent who do not make mobile payments. Futhermore, one-quarter of those who track spending with their smartphone report overdrawing their accounts, compared with 20 percent of those who do not track spending via their smartphone.

- Fin-tech users benefit from being financially literate, as those with higher levels of financial literacy are less likely to overdraw their checking account.

![]() The low level of financial literacy among millennials speaks of the importance of equipping this large generation with the knowledge and skills that are needed to make financial decisions in the digital era. This study shows that fin-tech users have different needs and characteristics, providing many opportunities for innovation for fin-tech developers.

The low level of financial literacy among millennials speaks of the importance of equipping this large generation with the knowledge and skills that are needed to make financial decisions in the digital era. This study shows that fin-tech users have different needs and characteristics, providing many opportunities for innovation for fin-tech developers.![]()

— Annamaria Lusardi, Academic Director at GFLEC